The price of gold is at an all-time high and an all-time high in real terms. Silver has kept up but should be 50% to 150% ahead, and the miners are still asleep. Institutional investors are ignoring this great opportunity because gold is not in their benchmark, and they remain highly confident in equities. What could possibly go wrong?

Going back 30 years, silver and gold have performed in line, turning $100 into around $700. Silver had been much higher in 2011 and is yet to regain those heights, but it will when the animal spirits return to the gold market. That is what this piece is about. Gold is trading at an all-time high while investors are watching from the sidelines.

Moreover, the gold miners, which are also supposed to smash gold during bull markets, are up just 56% in all that time. They have been making slow progress since the 2015 low. Some say valuations are much too low, while others feel they are terrible companies, but whatever your views, conditions are ripe. I am most focused on the fact that most investors ignore them despite the elephant in the room, which is the gold super bull market.

Gold, Silver and Gold Miners over the Past 30 Years

This chart expresses the same information relative to gold, rebased to $100 in 1995. Notice how silver has only ever lagged gold on rare occasions, such as during the 2020 pandemic crash. A rally would easily surpass 50% from here, and a 2011 rerun would be 150%.

Silver and Gold Miners Relative to Gold over the Past 30 Years

The gold miners are more curious because, despite all the human effort involved in discovering, financing, planning, mining, and refining new gold, the sector has lagged the gold price by an astonishing 80%. It remains my opinion that the January 2016 relative low was the lowest low we shall see, as that was a brutal reset. Since then, the gold miners have outperformed the gold price by 50%, which is a good start, but there ought to be much more to come. I say that because high gold prices (revenues) and low oil prices (costs) ought to make life highly profitable for them. At 38 barrels per ounce, there is plenty of room for profit margins to return to much higher levels.

Gold Miners’ Margins with the Gold Oil Spread

Yet investors have not been committing capital to precious metals, or their miners, since 2020 when prices last peaked. Gold ETFs are down 25% (in terms of ounces held in the vaults), silver ETFs are -30% and the miner ETFs are at multi-year lows.

Assets Held by Precious Metals ETFs

I use the VanEck Gold Miners ETF (GDX) as it is the largest of its kind and a good sector proxy.

In recent months, the gold ETFs have shown signs of life with the green shoots of recovery, but the same can’t be said about silver or the miners. Historically, the ETFs have been influential in setting the price of gold, but recently, that job has shifted to the central banks. The 2024 surge is the first to take place alongside ETF outflows.

Gold Price and ETF Flows

I see this as bullish because gold has shrugged off the selling pressure, which is largely down to changes in investors’ behaviour. I recently saw a former colleague working in a large wealth management firm, and he told me he was one of the few managers who still held gold for his clients, and the youngsters running other desks “didn’t get it”. I sense that this is happening in many other firms because gold is not in most fund managers’ benchmarks.

This is a very important point because, for an allocator to buy gold, they need to be sure that it won’t lag the stockmarket, which dominates their benchmark. No matter that allocators ought to hold gold in lieu of some bond exposure rather than equities because it historically has more in common, they don’t. They see it as an alternative to equities, and so for them to get bullish, the stockmarket needs to be in trouble.

I show gold and global equities in real terms (after accounting for inflation), where gold recently made a new all-time high vs the world index. Some see that as overvalued, but I see it as bullish. After all, since 1980, the global GDP is 10x higher, and the population has nearly doubled, which ought to account for something.

Gold and Global Equities in Real Terms Since 1970

The red areas highlighted show the periods when equities fell, and in virtually all cases, gold has performed well during those times. It is my belief that investors are more comfortable allocating to gold when stocks are doing badly than when they are doing well. I can’t prove that before gold ETF data was available in 2004 because it was harder to buy gold as an investor, but the idea makes sense and plays out in the data.

The price of gold is at an all-time high in both price and real terms. Silver has kept up but should be 50% to 150% ahead, and the miners are still asleep. Institutional investors are ignoring this great opportunity because gold is not in their benchmark, and they remain highly confident in equities. What could possibly go wrong?

Last month, I described the gold bull market as a “super bull”. This month, I’m adding “silent” because it’s a truly great bull market (super), with minimal investor attention (silent). The Silent Super Gold Bull is here.

21Shares ByteTree BOLD ETF (BOLD Switzerland)

BOLD is doing well and shrugging off Bitcoin’s volatility as the natural dovetail. I wonder whether silver or the miners will nip ahead first?

BOLD, Gold and Friends of Gold Since BOLD Inception

Earlier this week, I published my latest rebalancing report for the BOLD index. I am a keynote speaker at the Denver Gold Mining Forum Europe 2025, 31 March - 2 April, in Zurich. If you are attending and would like to hear about BOLD, then please reach out to bold@bytetree.com.

Summary

The Gold Silent Super Bull. What comes next?

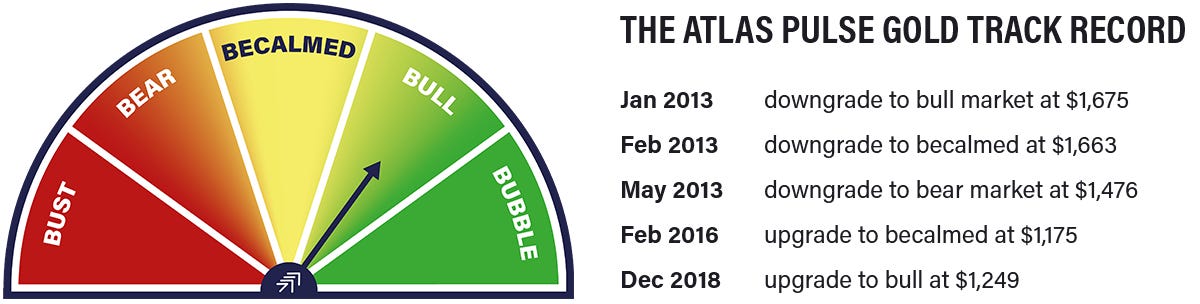

Thank you for reading Atlas Pulse. The Gold Dial remains in Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

We would love to hear your feedback, so please share your thoughts in the comments below or contact Charlie at charlie.morris@bytetree.com. It would really help us if you could like, restack/share this update and subscribe to our Substack. Thank you so much for your support!