Following rebalancing on 31st January 2025, the new target weights for the BOLD Index are 24.9% Bitcoin and 75.1% Gold, a 0.4% increase for Bitcoin over the previous month.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

In January, BOLD rose by 9.0%, Bitcoin rose by 9.0%, and Gold rose by 6.6%, while global equities rose by 3.5% in USD terms. Note that the US dollar index fell by 0.1% in January, bringing relief to financial markets.

The target weights last month were 24.5% and 75.5% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 25.6% Bitcoin and 74.4% Gold. This means the latest rebalancing has seen 0.7% added to Gold and reduced from Bitcoin to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities in USD – January 2025

BOLD Performance

Over the past year, Bitcoin has returned +140.5%, in contrast to Gold with +37.2%, while equities rose +19.7%. BOLD has returned +62.1% in US dollars.

Bitcoin, Gold, BOLD, Equities - Past Year

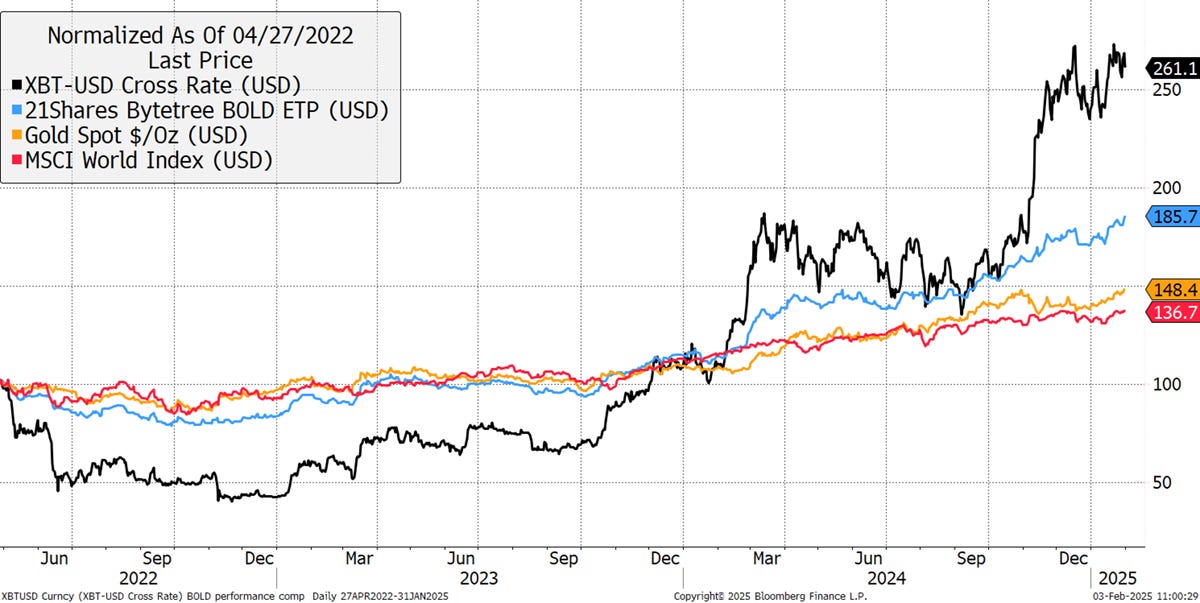

Since the BOLD ETP inception on 27th April 2022, Bitcoin is +161.1%, Gold is +48.4%, and equities +36.7%. BOLD has returned +85.7%. A fixed 75/25 Gold/Bitcoin strategy would have returned 76.2%, demonstrating the benefits of embracing monthly rebalancing transactions.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

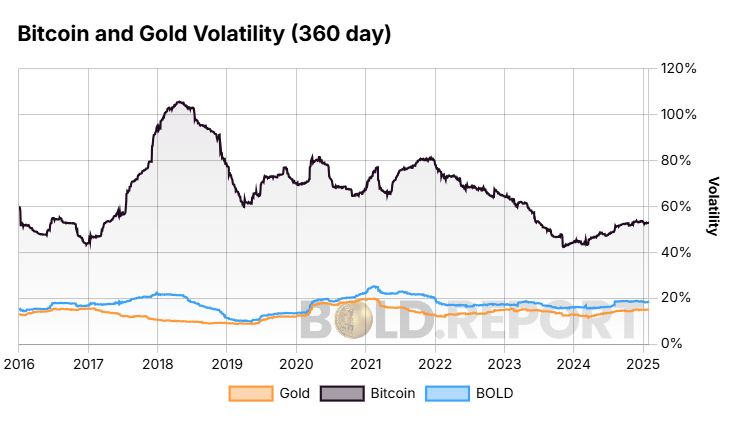

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 41.8% and 13.8%, respectively. Over the past year, Bitcoin has seen a modest increase in volatility compared to Gold.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 24.9% Bitcoin and 75.1% Gold using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Gold: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, then at the end of the month, it would be boosted to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold and Diversified Equities

Bitcoin and Gold Research

ByteTree Research publishes research on Bitcoin and Gold. In the latest issue of Atlas Pulse, The Gold Super Bull Market, I showed the price of Gold against the bond market. In the past, Gold used to move closely with bonds, but the world has changed.

Gold and Bonds

Gold has just passed $2,800, an all-time high, which demonstrates its strength as an alternative asset. Notice how BOLD keeps on making new highs ahead of both Bitcoin and Gold.

What If Bitcoin Collapsed?

I was asked the perfectly reasonable question of what would happen to BOLD if the price of Bitcoin collapsed.

Let’s assume collapse means Bitcoin fell 99% but continued to function. In the short term, the value of BOLD would fall by the Bitcoin weight, which is currently 24.9%, assuming the price of Gold stood still. If Gold rose, then the fall would be less, and if Gold fell, the loss would be a little more. Then, at the end of the next month, the index provider, Kaiko, would measure volatility for Bitcoin and Gold. Under such a scenario, Gold’s volatility would be unchanged, but Bitcoin’s would rise from circa 40% to well over 100% within days. This means that at the next rebalancing, the Bitcoin weight in the BOLD index would be less than 5%, so BOLD would closely resemble the price of Gold. In other words, BOLD would face a one-off loss from the fall of Bitcoin and then closely resemble Gold thereafter.

I see this unlikely scenario as another reason why holding Bitcoin and Gold together has its advantages because the worst scenarios are cushioned.

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow over the last three months, each seeing over $2 million in net inflows. The fund is now worth $19.7 million and trades actively in CHF, EUR, USD, and GBP in Switzerland, Germany, the Netherlands and France.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.