After much consideration, there will be a new development in Venture whereby holdings will either be reassessed or exited after a year. Great opportunities that need more time will have it, but for situations that have stagnated, it will be time to move on. This will help keep Venture concentrated with approximately 30 live ideas (it could be higher or lower) and will enable clients to know what’s coming. That will avoid a rush for the exit, which can be an issue for some of the small-cap ideas. I will refer to this as a one-year soft exit.

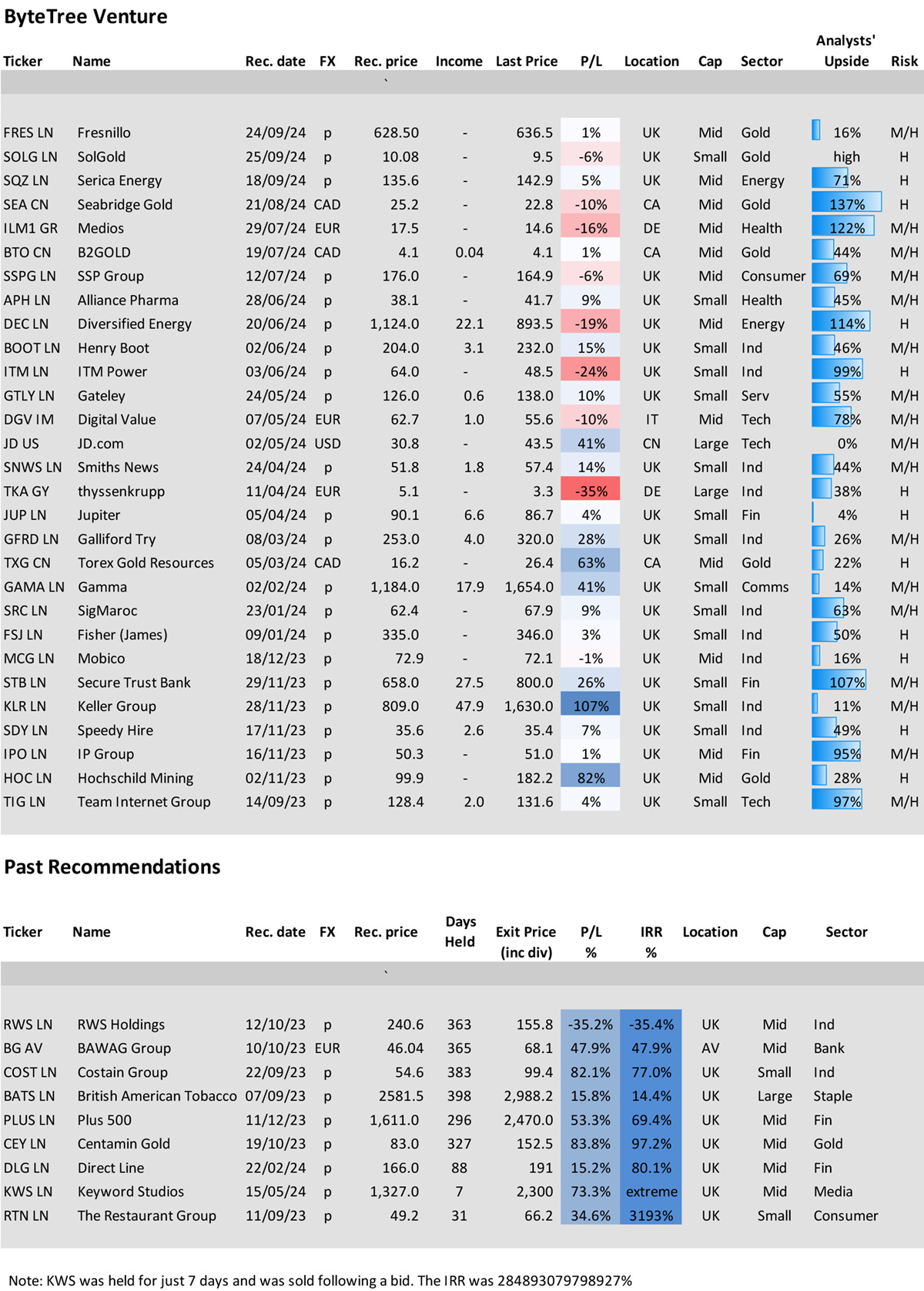

In last month’s Venture Review, I covered Hochschild (HOC), Diversified Energy (DEC), Costain (COST), Plus500 (PLUS), SigmaRoc (SRC), Gamma Communications (GAMA), James Fisher FSJ, B2GOLD (BTO), and Torex (TXG).

This month, I will cover events at Galliford Try (GFRD), Alliance Pharma (APH), SolGold (SOLG), Digital Value (DGV), Gateley (GTLY), IP Group (IPO), Henry Boot (BOOT). In the one-year soft exit, we will be holding Team Internet (TIG) and exiting British American Tobacco (BATS), RWS Holdings (RWS), BAWAG Group (BG AV), and Costain Group (COST).

Events

Galliford Try (GFRD) Annual results were positive, with strength across all divisions and group financials beating analyst estimates. Shares rose almost 10% on the news. With no debt and a strong order book, it is a growing business trading on 0.1x EV/Sales, a remarkably low valuation. Analysts have been raising their price forecasts repeatedly over the past 18 months. It will go ex-div on 7 November, with a 47% higher annual dividend than last year, reflecting the strength of the 2024 results.

Alliance Pharma (APH) H1 2024 results saw strong revenue growth in the Kelo-Cote segment, driving up group growth into positive territory at 2.8% (5% when adjusted for currency impacts). Group leverage was brought down from 2x in December 2023 to 1.8x in June ’24, and they expect it to reach 1.5x by the end of this year. This debt reduction is enabled by strong free cash flow generation (c. 10%).

SolGold (SOLG) released its Annual Report two days after our recent recommendation. Junior miners don’t have sales or income yet, just regulatory and operational progress, so there was little new in there. Key milestones in 2024 so far are the completion of the March pre-feasibility study, the exploitation contract agreed upon with the Ecuadorian government in June, and the $750m financing package in July.

Digital Value (DGV) H1 2024 results were good, which is typical for this steady, high-quality business. Revenues were up 8.5%, with next-generation data centres, now 55% of the business, showing the most growth. It is the 11th consecutive period of half-year growth, with a CAGR of 9%. At 4.95%, net profit margins were up from 4.11% a year earlier. The shares have responded with a small bump of 6%. It is still materially undervalued.

Gateley (GTLY) had its AGM in late September, where there was some dissension. Proposal 9, which would have allowed the company to hold virtual investor meetings, was voted down in the future. This was rejected despite, in the chairman’s words, the fact that in “the past five years, the average number of non-staff shareholders attending the AGM is less than one. Indeed, none of the institutional shareholders who voted against this resolution have appeared in person at our AGM in the nine years that I have chaired the business.” His full quotes highlight an interesting and underreported problem that is developing in public markets: the power of proxy advisors.

IP Group (IPO) H1 2024 results highlighted the successful sale of Garrison Technology Ltd for £30m (which will appear in the H2 financials), with further “exits” in late-stage negotiations at attractive prices. Their portfolio companies raised £380m in the period. Oxford Nanopore, their largest public holding, is up 60% since late June, and it was recently mentioned as a firm favourite at Baillie Gifford, a good long-term shareholder to have on board. Being publicly listed, it is responsible for most of the volatility in IPO’s NAV per share.

Henry Boot (BOOT) H1 2024 results showed strong sales and a small dividend increase. NAV remained flat, and while margins (return on capital) came in below the year before, they very much expect a strong second half to balance it out for 2024. Measured using “completed and exchanged on total land and property sales” as a smoother-metric, it reported £150.8m (vs £129.3m), which better reflects the revival of the business’ underlying growth.

ITM Power (ITM) The AGM took place on 8 October. They also announced the appointment of a new CFO, Amy Grey, on 12 September.

Upcoming Events

Repsol (REP) will announce 3rd quarter results on 31 October.

Speedy Hire Group (SSPG) will report results on 22 November. The most recent dividend was paid on 20 September.

One-Year Soft Exit

In the one-year soft close, we will be holding Team Internet (TIG) and exiting British American Tobacco (BATS), RWS Holdings (RWS), BAWAG Group (BG AV), and Costain Group (COST). October is an unusually busy month due to the recent implementation of this idea.

BATS was the first recommendation, as it was quite obviously undervalued and continues to be. There is no reason for long-term investors to sell BATS, which produces a good income, but it is no longer a Venture stock.

Exit price 2,695p, dividends 293.25p, P/L 15.8%, IRR 14.4%

COST has performed well. There is still some upside left, but the company hasn’t been known to deliver long-term value. The enterprise value remains low, but I believe we have seen the best bit.

Exit price 98.2p, dividends 1.2p, P/L 82.1%, IRR 77.0%

BG has been a solid performer, where we won over the sceptics. It still has a 26% analysts’ upside and is in an uptrend. No rush to sell, but time’s up.

Exit price €68.1, dividends €5, P/L 47.91%, IRR 47.9%

RWS trades on 6x earnings and has analysts’ forecasts 142% higher than the current price, implying a huge upside. The concern is that the company has gone ex-growth and is now more of a high-yield bond than an equity waiting to be re-rated. Time’s up, but we could revisit at a later date if things improve.

Exit price 155.8p, dividends 12.3p, P/L -30%, IRR -35.4%

Time Extended

TIG performed well before giving most back at their year-end results. Like RWS, it has a 97% upside, according to the analysts, but remains a growing company. I spoke with a major shareholder who was unimpressed with their shareholder communications, which lacked detail. He also explained how the two divisions, online marketing and online presence, were very different. Presence, a domain name business, makes up 21.8% of sales and 31.1% of profits. Market, which is still a growth business, faces greater competition and pressure on margins. A corporate action would unlock value here, and I believe we should give it more time. The dividend yield is 2.3%, and the free cash flow yield is 13.1%.

Summary

A little busier review this month, but I think this approach will help keep the portfolio fresh. There are now 29 live ideas and 9 exits, with an average return of 41.2%. Your feedback is most welcome.

Please let me know your thoughts by emailing me at venture@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, Venture

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 CryptoComposite Ltd