In a recent piece, I made the case for why the junior gold mining and exploration stocks would run as the price of gold kept on rising. It takes a lot to get a gold bull market started, but once it’s off, it can keep on going for years. The miners get dragged along until, eventually, investors catch on. As you’ll soon see, there’s no fever like gold fever.

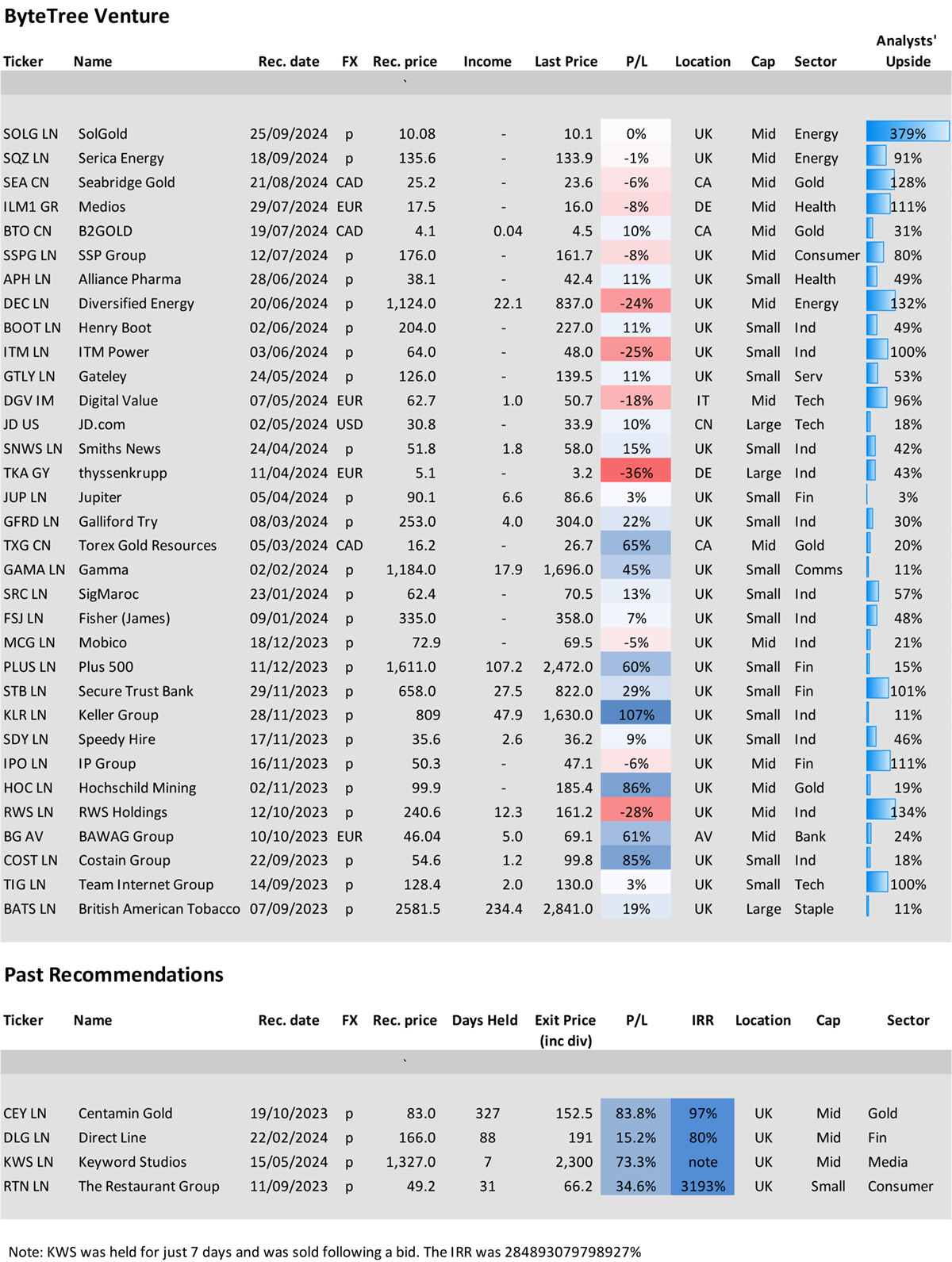

This is the sixth gold miner I have added to Venture since last year. Centamin (CEY) was recently bid for, capturing an 84% profit, with the others still running. The shift has moved from production companies to exploration because that is where the most value can be realised.

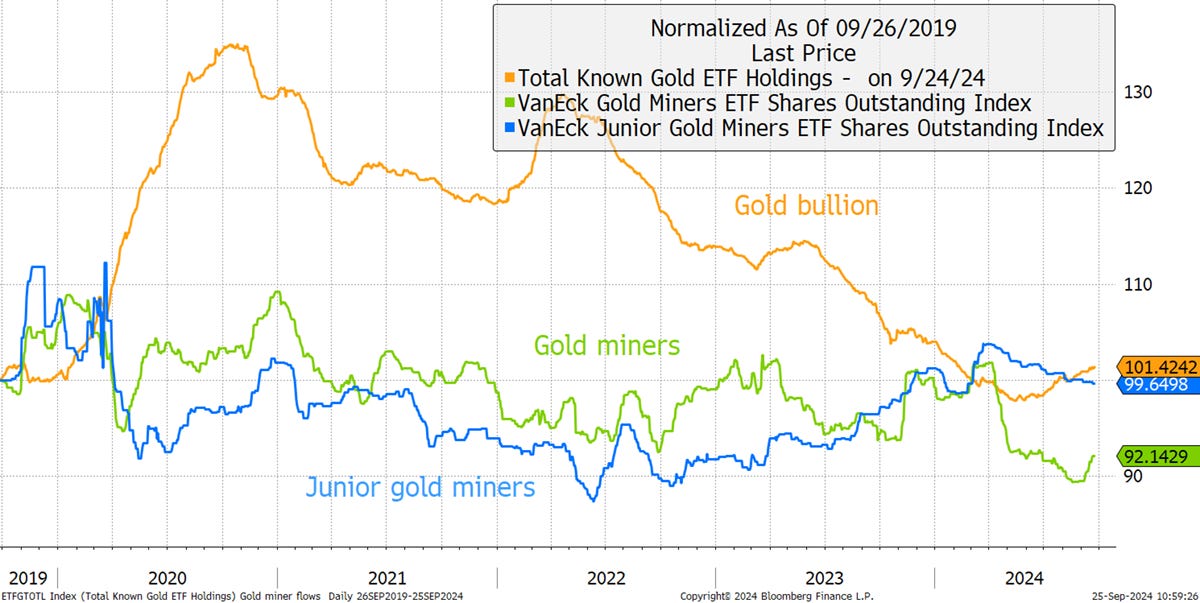

However, while conditions for gold fever are ripe, it hasn’t started yet. The smart money is in, but most investors remain on the sidelines. The flows into the gold ETFs have been negative since mid-2020 and have only just started to rise. The gold miners and junior gold miners have seen outflows this year despite the surge in the gold price. Investors couldn’t be less interested in this once-in-a-decade opportunity.

Flows into Gold and Gold Miners

Yet, 93% of gold stocks are in uptrends, and 82% for the juniors. ByteTree Venture has them on the radar, and with strong gold, low energy costs, a weak dollar, high-spending governments, an unstable world, and complacency on inflation, the gods are on gold’s side.

SolGold Plc (SOLG UK, SOLG Canada)

An opportunity in Ecuador:

“SolGold is an emerging multi-asset major and leading exploration company focused on the discovery, definition, and development of world class copper and gold deposits. SolGold is one of the largest concession holders in Ecuador exploring the length and breadth of this highly prospective section of the Andean copper belt. We are positioned to support Ecuador’s transformation into the next copper frontier that the world needs to achieve a net zero future.”

SOLG is a junior miner sitting on a large gold and copper asset in Ecuador named Cascabel. It is the largest undeveloped copper resource in Latin America that is not controlled by a large mining company. It has one of the largest gold resources amongst primary gold mines and assets worldwide, again not controlled by a major.

In July, SOLG was fully financed by Franco Nevada (70%) and Osisko Gold Royalties (30%) to the tune of $750 million to take the mine to production. This is a significant vote of confidence in the project that is set to produce in five years. That is a long time away, but they sit on proven reserves of 12.4 million tonnes of copper and 31.3 million ounces of gold. It is a substantial asset.

Five years is a long time to wait, but so long as gold and copper prices remain firm, hungry investors will take the bait early. Not only is gold strong, but copper is too. The summer lull in commodity prices seems to be over, and many would be surprised to learn that copper remains in a strong uptrend. Yesterday’s Chinese stimulus package went down well.

Copper Futures See a 5/5 ByteTrend Score

Cascabel is a “Tier 1” asset, which means it’s an asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold and total cash costs per ounce in the lower half of the industry cost curve. On the shareholder register are BHP, Newmont (via the Newcrest Acquisition), and Jiangxi Copper. Furthermore, SOLG has a large land package in the region with the opportunity to explore further afield.

Ecuador is not currently a famous mining destination, but it has become the country’s fastest-growing sector, with strong government support. However, some local indigenous protests have affected mines there, and that remains a risk. Cascabel has access to key infrastructure such as water, hydropower, and roads. That said, there is currently a drought, which has rationed power. Perhaps this has held back the share price.

The mine is based on the Andean Copper Belt, which has some of the world’s best geology. Three large companies (Lundin, Solaris, and China-backed EcuaCorriente) are already producing or developing there. China has a free trade agreement with Ecuador and is the biggest buyer of gold and copper in the world. The Esmeraldas Port is 180 km away, enabling efficient trade with China.

Permitting is set to be completed next year, with production not starting until 2026. They have done the Pre-Feasibility Study (PFS), and now they need an environmental permit and a Definitive Feasibility Study (DFS).

While some promising juniors like Skeena and Artemis Gold have gone gangbusters with the gold rally (they are closer to production), SOLG has been falling back from its post-discovery excitement of the last few years. Hence, the valuation is very low relative to reserves and peers. With a market cap of £304 million, this project appears to be significantly undervalued, and with the gold sector poised to perform, I doubt SOLG will be left behind.

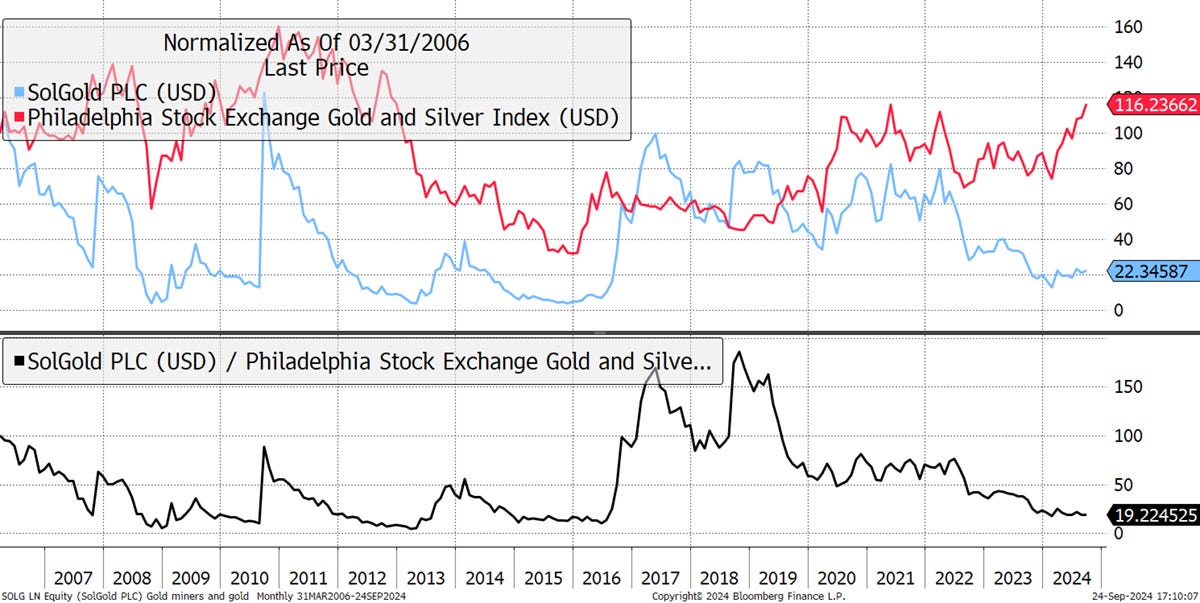

The gold bull market kicked off in late 2018, and SOLG has lagged the mining sector by 87% since. My observation is that other exploration stocks are on the move, and SOLG has been neutral to the sector for a year.

SolGold and the Gold Miners

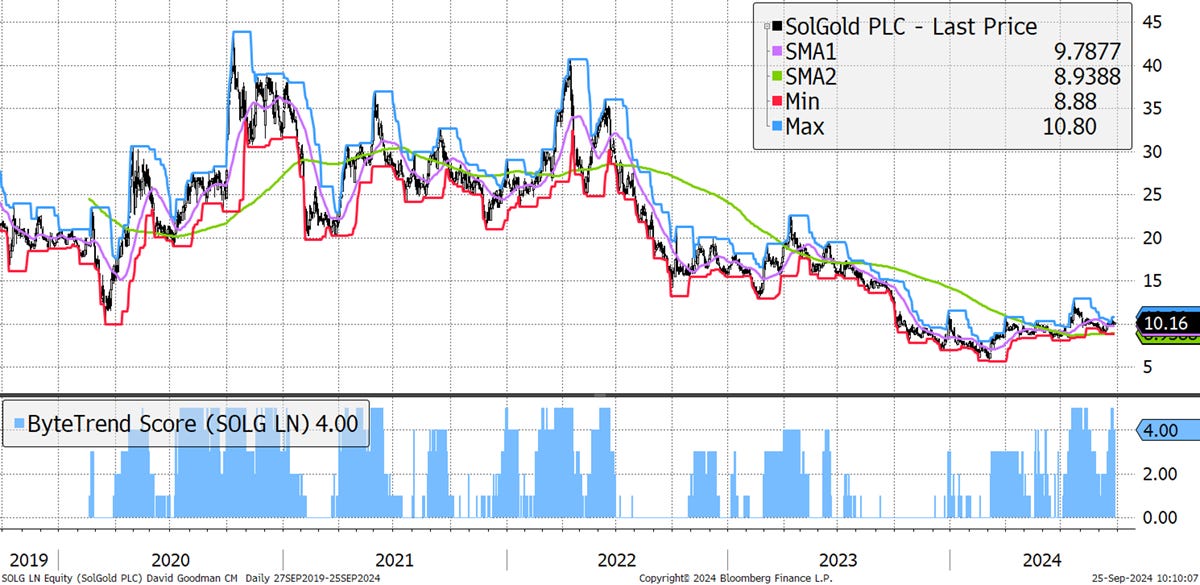

Technicals

The short-term chart is encouraging as the trend has turned positive.

SolGold Uptrend

And has done so for the first time since 2022.

SolGold Uptrend After a Prolonged Slump

The CEO, Scott Caldwell, was previously the CEO at Guyana Goldfields, which was bid for in 2020. Prior to that, he was CEO at Allied Nevada until 2013. Before that, he was the Chief Operating Officer at Kinross Gold (K Canada). At SolGold, he was a non-exec on the board and initially appointed Interim CEO in 2022, but was made permanent in 2023, suggesting he’s doing a good job.

Two analysts cover the stock (both buys), with a consensus price target of 48p against a price of 10p, implying a 300% upside. The most bullish forecast is from Hannam and Partners of 63p, and the other from Cantor Fitzgerald of 33.4p. The next results for 2024 will be published on Monday, 30th September 2024. That could provide the catalyst for a rally.

With a large reserve, financing secured, and a low valuation, SOLG is well-placed to participate in this gold bull market.

Risk

The risks are high. Investing in exploration stocks is a high-risk activity and is speculative. Permitting can take longer than expected, construction often has overruns, and there are no guarantees the gold price will remain firm. If gold were to turn, SOLG would follow. The shares are somewhat liquid, trading £500k per day on average. Volatility is high at 65%. I deem SOLG to be high-risk.

Please let me know your thoughts by emailing me at venture@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, Venture

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 CryptoComposite Ltd