We are pleased to inform our clients of the updated track records for the services offered at ByteTree in 2024 and discuss the portfolios and the outlook for this year.

Key Points

The biggest stocks were the best performers, something we rarely see. They were US-based companies, and they drove the S&P 500 Index, comfortably beating other stockmarkets around the world. The concentration of value in the largest stocks has not been at these levels since 1929, prior to the great crash.

Bonds had another down year in most categories, but corporate credit outperformed government. China was the notable exception, where low interest rates caused government bonds to surge.

FX saw the US dollar lead the world, rising 7.1% against a global basket.

Gold beat most commodities by a wide margin, with the exceptions of natural gas and coffee, which both surged in the fourth quarter. Gold miners lagged the gold price.

Bitcoin showed clear leadership over the crypto sector.

You could summarise 2024 as a year where big is beautiful.

Diversification didn’t add value due to the concentration of returns.

At a Glance - ByteTree Returns for 2024 in GBP

I will go through each portfolio and provide a performance overview.

The Multi-Asset Investor

A diversified portfolio service that blends traditional bonds and equities with alternative assets such as gold, commodities, and bitcoin. It combines two portfolios, Soda and Whisky.

Soda

A long-term, low turnover portfolio investing in diversified large cap stocks, funds, exchange-traded funds (ETFs) and investment trusts.

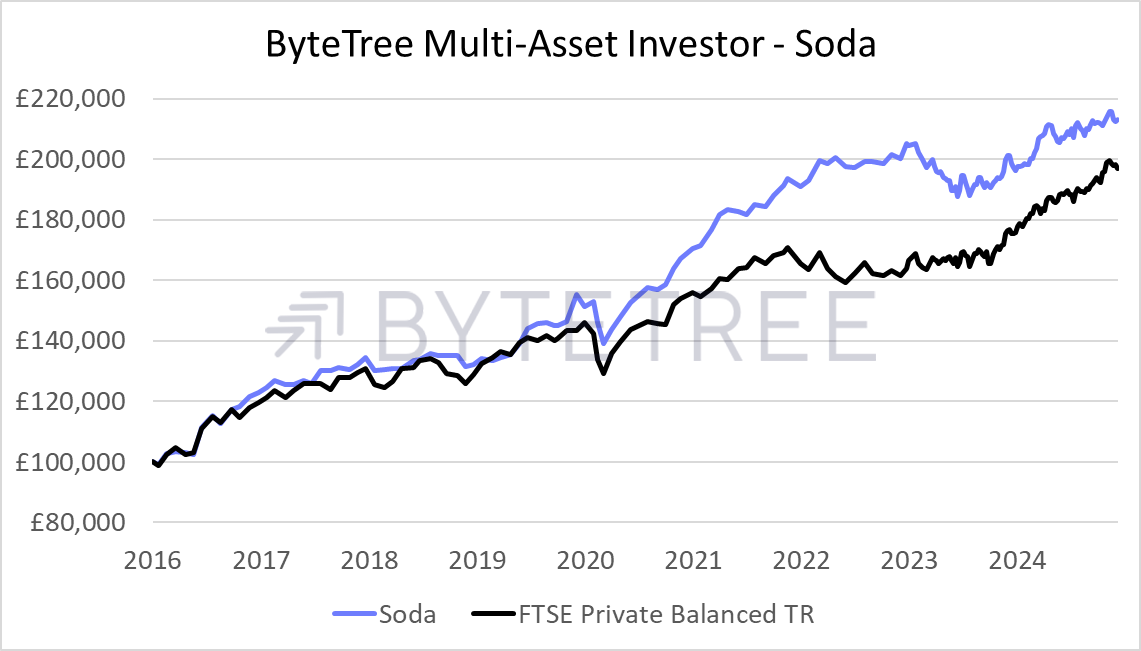

After a commanding lead in 2022, Soda has had another year behind the FTSE Private Balanced Index, a benchmark for private investors. It returned 6.0% against 11.3% for the FTSE Balanced. That index is heavily exposed to US equities, an area I believe is exposed to dangerously high valuations. A UK 60/40 FTSE All Share/Gilt index returned +4.2%, not that it matters, but it demonstrates the gap between US equity returns in 2024 and the rest of the world.

Soda vs FTSE Private Balanced Index

In 2024, I have been too cautious. Despite calling the resumption of the bull market in October 2022, I didn’t grab it by the horns in the Soda Portfolio, where capital preservation comes first and foremost. This two-year performance lag in an era of US dominance has been painful, but I believe it will sooner or later be reversed by changing nothing at all. Soda will continue to reject the stockmarket bubble.

Soda Performance

Soda continues to hold some defensive positions, including gold and the yen, which would perform well if financial markets came unstuck. There are also many value positions, such as deeply discounted investment trusts that have risen in value, but it is still early days. They have much more to give.

The current portfolio remains defensive, with pent-up value. When interest rates start to fall, it has the potential to do very well in 2025.

Whisky

A tactical, actively traded portfolio investing in mid to large cap stocks in developed markets, investment trusts, global ETFs and bitcoin.

Whisky returned 11%, narrowly beating the FTSE 100, which returned 9.8%, after including dividends. It was a mixed year, with some successful exits in emerging markets internet that benefitted from the China rally in the summer. There was also the sale of the Pakistan ETF, which was acquired after a prolonged -72% bear market. It was a good opportunity that was barely talked about in the financial press.

Towards the end of the year, we also successfully traded the crypto equity ETF, selling close to the peak, returning 70% in two months by capturing a ride on the back of MicroStrategy (MSTR), which was the largest holding. It is the most absurd stock I have ever come across and has become the most traded on platforms such as Hargreaves Lansdown. UK investors buy it as a Bitcoin proxy because the Bitcoin ETFs are banned. That is why MSTR trades at a premium to NAV (circa 150%), not because the CEO is a financial magician.

In November, the premium reached 288%, meaning shareholders were valuing $100 of Bitcoin at $388. Unsurprisingly, since that time, Bitcoin is up 2% and MSTR is down 37%. The premium doesn’t deserve to exist but will continue due to regulatory arbitrage. Therefore, the next big risk is that the FCA, and others, ease up on Bitcoin ETFs, at which point, MSTR shareholders will be wiped out, even though Bitcoin carries on rising. I sincerely hope that ByteTree clients are not using MSTR as a Bitcoin proxy.

Gold miners and silver played an important role, yet again they lagged gold. You’d normally expect them to deliver 50% more in a bull market. The lag has been so prolonged that it is likely to look more like 100% going into the new year.

There were also some disappointments, such as Stellantis, which was caught up in Europe’s implosion of the auto sector. More importantly, some new additions such as Wise Plc, the payments company that thinks there is no need for stablecoins, and Smiths Plc (SMIN), which will securely let you get onto an aircraft without opening your hand luggage. There are some great stocks in Whisky, and more on the way.

Whisky vs FTSE 100

The long-term performance remains strong, with historical returns of 5.2% per annum, higher than the market since inception in 2016, but with similar volatility in recent years. That gap means the index delivered 85.3% compared to Whisky’s 182.8%. I hope we break into the 200% territory this year.

Whisky Performance

Much of the excess return has occurred in the tricky years, such as 2020, when the portfolio characteristics and risk management prevented losses experienced by the market. Whisky stocks are researched using fundamental principles and in search of value. Not only has Whisky made good money over the years, but value is also the only investment strategy you can be sure of when things go wrong.

BOLD

Aims to deliver protection against monetary inflation, giving optimal risk-adjusted exposure to Bitcoin and Gold.

BOLD rose 50.7% in GBP last year, with volatility only slightly above that of gold. BOLD is a spectacular asset combination with high risk-adjusted returns. The detailed report on BOLD in 2024 can be found here.

21Shares ByteTree BOLD ETF Since Launch

I am not sure there is any ETF out there with a higher Sharpe ratio than BOLD.

The Adaptive Asset Allocation Report

A model-driven business cycle trend-following approach to investing.

The Adaptive Asset Allocation Report (AAA), written by Robin Griffiths and Rashpal Sohan, had a good year, returning 12.1% in GBP versus the world index, up 21%. Although they held many of the 2024 winners, such as US large-caps and tech, alongside gold, diversification into other areas rarely paid off. Steps into India were reversed, and China, we shall see. The AAA team captured most of the big themes, but a few “cameo appearances” held them back.

When markets are more evenly spread, trend following works wonders. I have always had huge respect for the “process” of trend following because it is so logical. Of course, everyone tries to buy things that are going up, but the momentum purists don’t buy strong assets; they buy the strongest. The caveat is how many trends continue or reverse.

Rashpal and I are working on an idea that will hopefully become the research version of my Global Trend Fund. The idea will be to be prepared for the great rotation in markets when the US technology thing finally wares. The focus will be on large-caps in all countries, and I’m excited about it. Stay tuned, and in the meantime, please brush up on my momentum work.

ByteFolio

A model portfolio designed to outperform Bitcoin.

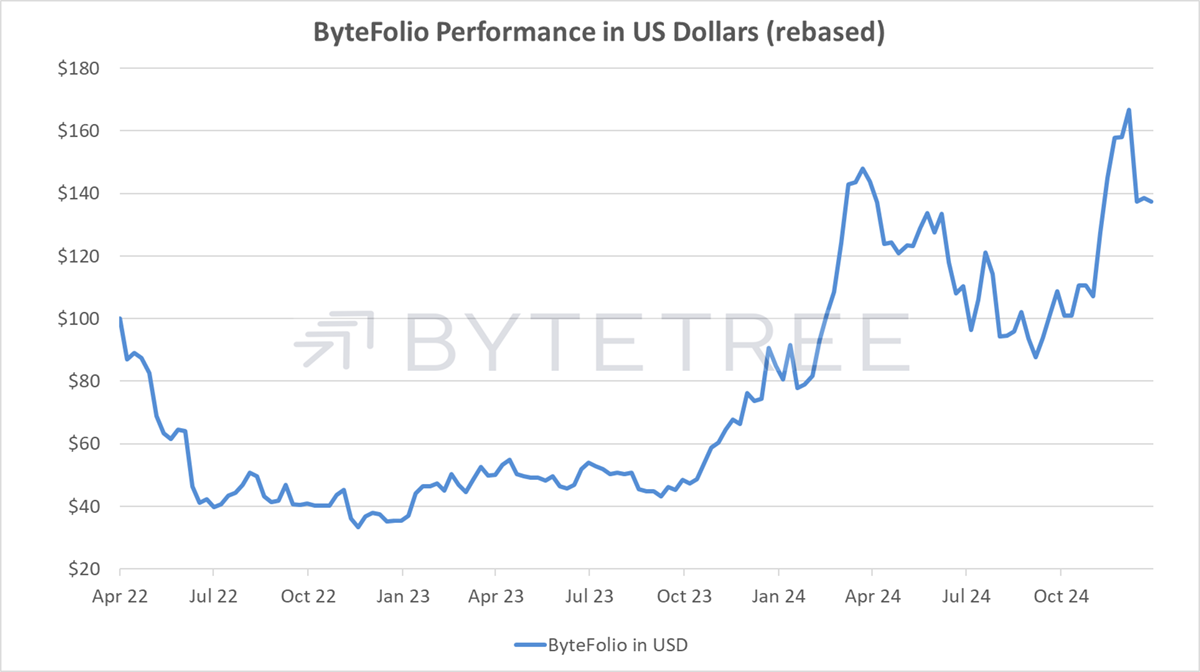

ByteFolio rose by 115% last year in USD, which is fabulous in a bull market that began in Jan 2023. It was slow going at first but soon picked up. The crypto space is once again full of beans, quite literally.

Crypto has been a tough market, despite rising prices, because the best strategy has been to simply hold Bitcoin. That is difficult for ByteFolio as its raison d'être is to identify the leading digital assets of the future, so the portfolio has blended a relatively large bitcoin holding alongside a concentrated portfolio of tokens while we patiently await altcoin season. It’s long overdue, and 2025, with Trump in the White House, looks promising.

Venture

For experienced investors looking for more opportunities.

I can only publish the closed trades, which have averaged 44% held for 280 days. There are 26 open trades with three trades extended because I believe there will be a better exit price in the near future.

Venture Past Recommendations

Venture is comprised of small, mid and large-cap stocks from the UK, Germany, Italy, Netherlands, Japan, and the US. The common thread is that the share price has been falling for several years, and there is compelling value on offer.

ByteTree looks at various value measures, trends, forecasts, balance sheets, cash flow, assets, ownership, insiders, and more. If you want to learn how we assess companies, I have written a series of articles called My Journey in Finance that explain concepts and ideas that I have learned about over the years. That is the basis for stock selection in Whisky and Venture, with the latter more focused on small and mid-caps and more exotic or esoteric situations. There will be much more to come in 2025 (if I ever find the time).

Summary

It has been another interesting year, with no shortage of events for the history books. But I felt the more fundamental the approach, the worse the result. Compare Venture, Whisky, BOLD, and ByteFolio, which have all had a good or a splendid year, then look at Soda. It has so many great holdings but had little reward, simply because things like closed-ended funds listed on the London Stock Exchange were largely ignored. I suspect 2025 might see that change.

Thank you to all ByteTree clients for your continued support, and I wish you a prosperous and happy 2025.

Interested in any of the services we have to offer? Get in touch with us at substack@bytetree.com, and we will be delighted to assist you.