Following rebalancing on 30th December 2024, the new target weights for the BOLD Index are 24.5% Bitcoin and 75.5% Gold, a 0.5% increase for Gold over the previous month.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

In December, BOLD fell by 2.8%, Bitcoin fell by 5.7% (trading calendar month), Gold fell by 1.4%, and global equities fell by 2.4% in USD terms. Note that the US dollar index rose 2.6% in December and 7.7% over the quarter, which has weighed on prices.

The target weights last month were 25% and 75% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 76% and 24%. This means the latest end-November rebalancing has reduced 0.5% from Gold and added to Bitcoin to meet the new target weights.

Bitcoin, Gold, BOLD, Equities and in USD – December 2024

BOLD Performance

Over the past year, Bitcoin has returned +110.7%, in contrast to Gold with +26.6%, while equities rose +17.3%. BOLD has returned +46.2% in US dollars.

Bitcoin, Gold, BOLD, and Equities - Past Year

Since the inception of the BOLD ETP on 27th April 2022, Bitcoin is +135%, Gold is +38.2%, and equities are +32.5%. BOLD has returned +81.1%. A fixed 75/25 Gold/Bitcoin strategy would have returned 62.4%, demonstrating the benefits of embracing monthly rebalancing transactions.

Bitcoin, Gold, BOLD, Equities – Since Inception

A BOLD Year for Bitcoin and Gold ETFs

In 2024, the Bitcoin exchange-traded funds (ETFs) saw record growth, fuelled by new product launches in the USA. Total Bitcoin held by ETFs grew from 843k BTC to 1.288m BTC, now worth $121 bn. In contrast, the Gold ETFs fell from 87.4 moz to 86.9 moz, a modest fall. Still, the total Gold held by the ETFs amounts to $229 bn. The total held in Bitcoin and Gold ETFs now amounts to $350 billion. These assets are becoming an important allocation for global investors.

Gold and Bitcoin ETFs Assets Under Management

With Bitcoin’s halving in May and the US ETF launches in January, there has been much to be excited about. Gold, on the other hand, has been largely ignored despite its strong performance. The Bitcoin buyers have been largely US retail investors, whereas in Gold, it has been the non-OECD central banks, led by the People’s Bank of China.

The central banks have favoured Gold over US treasuries, which was their go-to reserve asset until that trend peaked in 2012. At that time, foreigners owned 25% of US treasuries, which has since dropped to 10%. Gold continues to be steady in the face of rising bond yields, which normally weighs on the Gold price. It has been steadily outperforming the US long bond since 2005 and even more so since 2020.

Gold Shrugs Off Bonds

Bitcoin and Gold are alternative assets, along with commodities, fine wine, sports cars, and Renoirs. Yet Bitcoin and Gold are hugely liquid assets, which means you can easily buy or sell $1bn worth in a heartbeat. You could do that in oil as well, but there is no limited supply, and physical ownership is costly and inconvenient. Bitcoin and Gold truly stand out as the world’s most important liquid, alternative, and monetary assets.

The sceptics are always questioning how to value Bitcoin and Gold. They criticise the lack of cashflows, which don’t exist, but they are missing the point of the attractiveness of liquid alternatives. You wouldn’t want an asset that is part of the financial system to protect you from the failure of that same financial system. To my mind, Gold is the alternative to bonds, and Bitcoin is the alternative to equities. Stick them together, on a risk-weight basis, and you have the optimised, highly liquid, alternative asset pairing.

Due to the low correlation between Bitcoin and Gold, when you combine them, there are diversification benefits. Holding silver alongside Gold doesn’t do that, nor does holding Ethereum alongside Bitcoin. But holding Bitcoin and Gold does.

Bitcoin has had 42.0% volatility over the past 90 days, which is in line with Dollar Tree (DLTR). Gold had a volatility of 15.9%, which is in line with Johnson and Johnson (JNJ). BOLD had a volatility of 18.7%, which is in line with Costco (COST). If there were no diversification benefits, BOLD’s volatility would reflect the 75/25 split, which comes to around 22.4%. That 3.7% drop comes courtesy of the diversification benefits. Holding BOLD is only slightly more volatile than holding 24-carat, 999.9-fine Gold.

I can illustrate this using a financial performance measure called the Sharpe Ratio, which measures risk-adjusted returns. That measures return after accounting for risk, measured by volatility. The simple Sharpe divides annualised return by volatility.

Bitcoin, Gold, BOLD Sharpe Ratios

BOLD has a far superior Sharpe ratio compared with Bitcoin, Gold, and global equities, including dividends. That means if you wanted to match Bitcoin’s returns, you could leverage BOLD by 50% and still be taking materially less risk than by holding Bitcoin alone. Alternatively, you could match Gold’s returns by deleveraging, as a $50 allocation to BOLD may likely keep up with a $100 allocation to Gold. That is not guaranteed, but seemingly likely. Don’t forget that the monthly rebalancing transactions are a key component of the returns, and I estimate them to be around 5% per year, depending on market conditions, and that soon adds up.

I created this strategy to solve a problem. Bitcoin and Gold should not be seen as a choice an investor needs to make but rather a combination to gain efficient exposure to the world’s most liquid alternative assets that play different roles. They are better together, and essential during these uncertain times in the global economy.

Monthly Rebalancing of the BOLD ETP

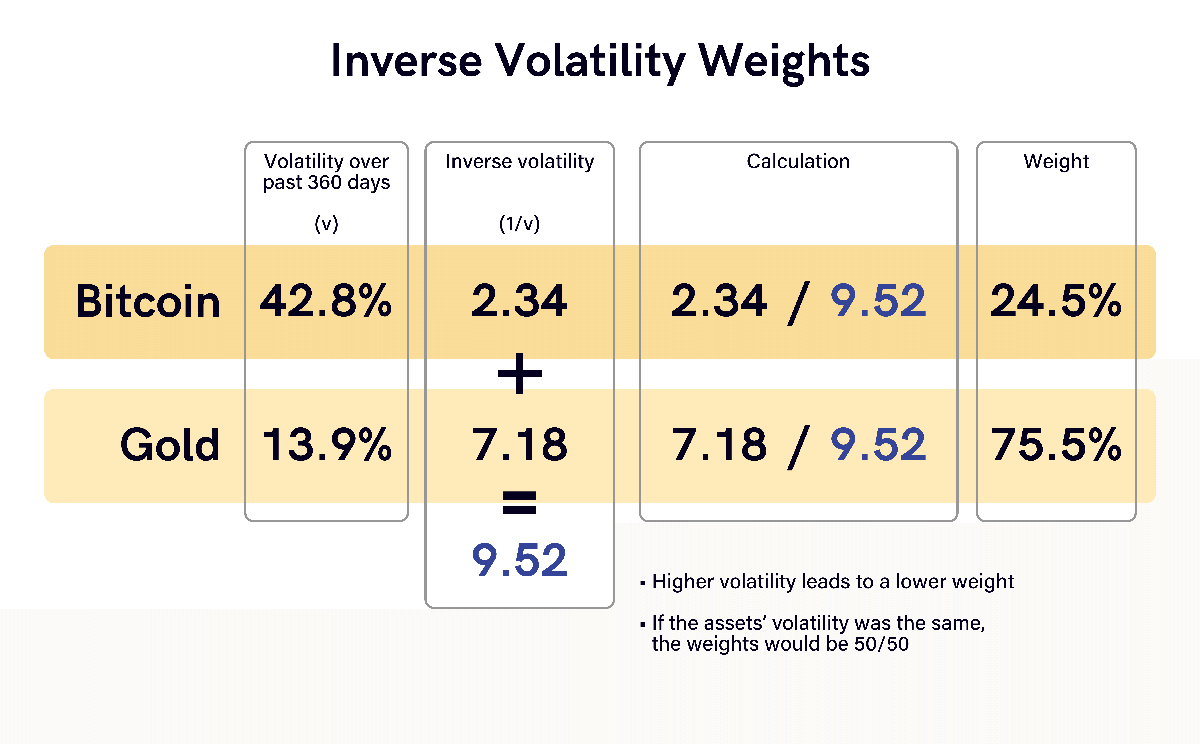

BOLD allocates Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 42.8% and 13.9%, respectively. In 2024, Bitcoin has seen a modest increase in volatility compared to Gold.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 24.5% Bitcoin and 75.5% Gold using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, BOLD’s Bitcoin allocation has generally been in the 20% to 25% range, with the remaining balance in Gold.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Gold Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, then at the end of the month, it would be boosted to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

If Bitcoin was particularly strong one month or Gold was weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low, which is a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold and Diversified Equities

Bitcoin and Gold Research

ByteTree Research publishes research on Bitcoin and Gold. In the latest issue of Atlas Pulse, The Long-Term Gold Supply, I showed a hard-to-get chart that looked at the total amount of US government debt against the total value of the above-ground Gold supply. It helps to explain why the Gold price is influenced by rising levels of public debt, which is evident not just in the USA.

Gold Market Cap to US Treasury Market Cap

Summary

It has been another good year for BOLD. Assets in the 21Shares ByteTree BOLD ETF (BOLD) grew from $6m to $16.2m as investors have started to embrace this strategy. Monthly volumes have exceeded $2m for the past two months, and activity has grown in all share classes.

21Shares ByteTree BOLD ETF Price and Volume by Share Class in US$

I thank all investors for their continued support.

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.