Following rebalancing on 28th February 2025, the new target weights for the BOLD Index are 25.5% Bitcoin and 74.5% Gold, a 0.6% increase for Bitcoin over the previous month.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

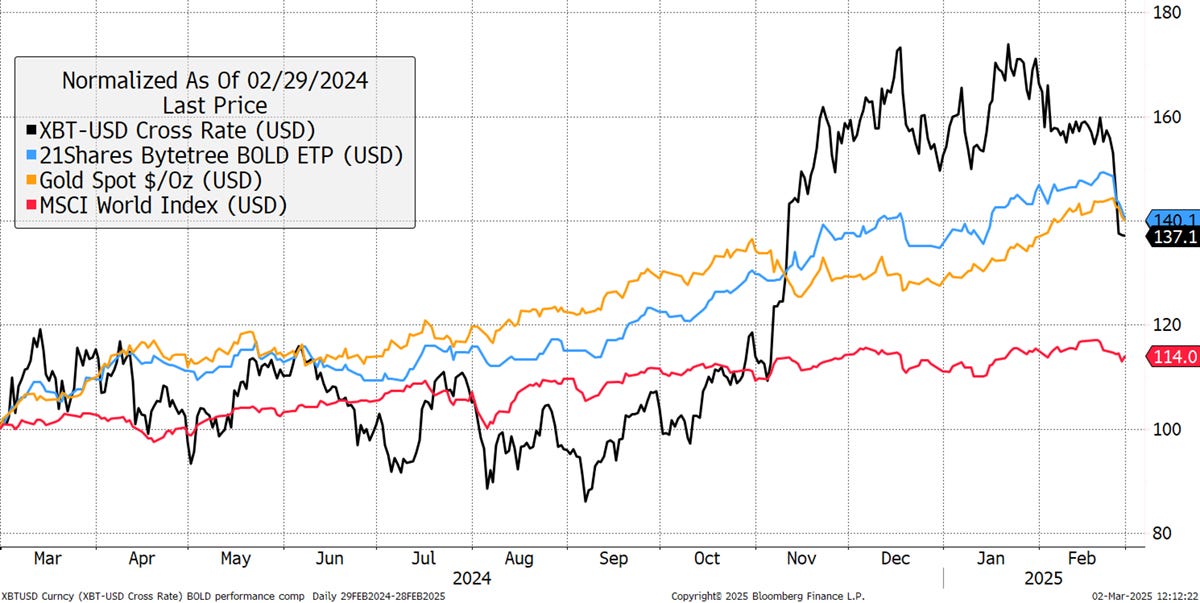

In February, BOLD fell by 4.5%, Bitcoin fell by 17.5%, and Gold rose by 2.1%, while global equities fell by 0.8% in USD terms.

The target weights last month were 24.9% and 75.1% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 20.5% Bitcoin and 79.5% Gold. This means the latest rebalancing has seen 5.0% added to Bitcoin and reduced from Gold to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities in USD – February 2025

BOLD Performance

Over the past year, Bitcoin has returned +37.1%, in contrast to Gold, which has returned +39.8%, while equities rose +14.0%. BOLD has returned +40.1% in US dollars. Although slight, BOLD is ahead of both Bitcoin and Gold over the past year, demonstrating the benefits of a rebalancing strategy.

Bitcoin, Gold, BOLD, Equities - Past Year

Since the inception of the 21Shares ByteTree BOLD ETP on 27th April 2022, Bitcoin is +115.3%, Gold is +51.5%, and equities are +35.5%. BOLD has returned +77.3%. A fixed 75/25 Gold/Bitcoin strategy would have returned 67.5%, once again demonstrating the power of rebalancing. That 9.8% outperformance comes after fees.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 41.9% and 14.0%, respectively. Bitcoin’s volatility has risen by 0.1% over the past month, and Gold’s by 0.2%, hence the slightly large position in the bitcoin target weight compared to last month.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 25.5% Bitcoin and 74.5% Gold using this formula.

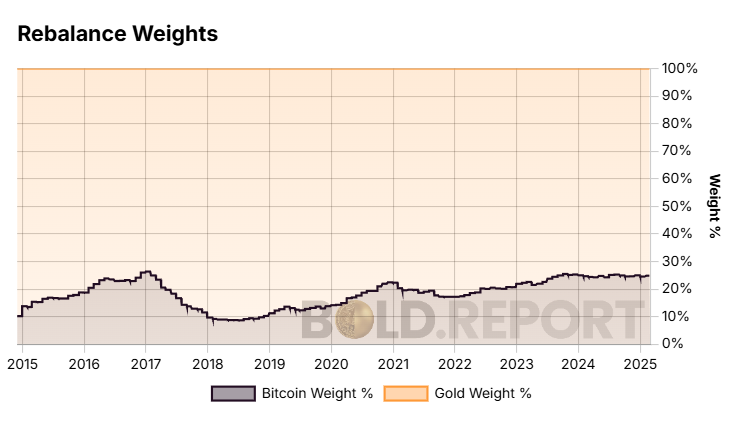

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Gold: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, like it did in February, it would be boosted back up to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold and Diversified Equities

Bitcoin and Gold Research

ByteTree Research publishes research on Bitcoin and Gold. In the latest issue of Atlas Pulse, Gold’s Super Silent Bull, I discussed the market for silver and the Gold miners and the reasons for the low investor interest in Gold despite a high Gold price.

Gold, Silver, Gold Miners and BOLD

Then, last week, things changed as Gold flows took off with the largest single week into Gold ETFs in history.

Gold Held by ETFs

Bitcoin, on the other hand, saw the largest weekly outflows on record.

Bitcoin Held by ETFs

This highlights the counter-cyclical nature of Bitcoin and Gold from an investor’s perspective. The next chart shows the net investment into the Bitcoin and Gold ETFs. Using the +30bn to -$15bn scale, Bitcoin flows (including Europe, Canada and Grayscale in 2020) didn’t register until 2020 when they became large enough, while Gold ETF flows regularly swung between +/- $15bn. Then, in late 2020/early 2021, Bitcoin flows surged to $10bn while Gold saw hefty outflows at the same time. Since then, a very clear counter-cyclical pattern has emerged between Bitcoin and Gold investor flows. Currently, the tide is going out for Bitcoin and coming in for Gold.

Bitcoin and Gold ETF Inflows in USD

Bitcoin ETF flows have increased significantly in 2024 as the ETFs were launched in the USA. After the Trump election in November, these surged to $20 bn over a 90-day period, which is similar to the periodic levels seen in Gold. It demonstrates a material change for Bitcoin, as it now has the ability to larger investor flows on an institutional level.

The main point is their natural counter-cyclicality, which means Bitcoin and Gold take it in turns to perform. It is rare that investors favour, nor reject, both assets at the same time. Holding both assets, with the appropriate weight and frequent rebalancing transactions, leads to a very satisfactory outcome.

Please sign up to receive updates on BOLD.

Alternatively, please visit the BOLD website, which is full of data and charts to help investors better understand the benefits of the strategy.

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow over the last three months, each month seeing over $2 million in net inflows. The fund is now worth $20.9 million and trades actively in CHF, EUR, USD, and GBP in Switzerland, Germany, the Netherlands and France.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.