It will be an exciting time for bitcoin and gold. The debate will rage on, but I believe they both deserve to be much more widely owned.

Highlights

Gold ETFs They transformed the Gold Market

Bitcoin ETFs SEC Approval

Flows Gold vs Bitcoin

BOLD Bitcoin AND Gold, not OR

Gold ETFs Transformed the Market

Cast your mind back to 1999. If you wanted to own gold as a professional investor, you bought gold in the Mercury Gold and General Fund, later renamed Merrill Lynch in 2000 and BlackRock in 2006. The other choice was the Central Fund of Canada (CEF), now Sprott. But both had sub $100 million of assets under management. Alternatively, you might have bought gold futures, but most funds and private clients would have struggled for practical or legal reasons.

Physical gold, while it sounds appealing, is a nightmare for a fund and its auditor, which is why there is such an important role for gold custodians. But even if you managed to overcome the custody problem, in the UK in the 1990s, there was also VAT. Buying gold meant you had to grease the taxman’s palm.

In 2003, Graham Tuckwell and his team at ETF Securities came up with a solution. They launched the first gold ETF, Gold Bullion Securities, in Sydney. This template was replicated in London in December 2003, and again in New York by State Street in a joint venture with the World Gold Council in November 2004.

Mainstream investors now had a simple way to safely invest in gold, and the impact on gold mining share valuations was devastating, as witnessed by the Gold and General Fund’s relative performance. It outperformed gold up until 2008, only to give it back thereafter. I am in no way criticising the fund’s performance, merely highlighting the impact on gold mining valuations, which slumped as the assets held by gold ETFs soared.

The Impact on Gold Mining Shares as Gold ETFs Grew

In the noughties, the price appreciation and behaviour of gold was spectacular. It made money in the 2000 to 2002 dotcom crash. It then managed to keep up with the stockmarket in the 2002 to 2007 bull market. Then again, when the credit crisis came in 2008, it made money in all currencies other than the Yen (-14.1%) and the Swiss Franc (-0.3%).

After two decades in the doghouse, the 1980s and 1990s, gold proved to be a spectacular portfolio diversifier, and demand was insatiable. By 2012, the gold ETFs were collectively worth $140 billion. Back then, that was real money, which made up 17.5% of all global equity ETF assets at the time ($863 billion).

Gold ETFs in 2012 Equated to 17.5% of Equity ETFs

Since then, equity ETFs have grown 7-fold and recently passed $6 trillion. Gold ETFs have grown too, but at a more pedestrian pace. They are collectively worth $156 billion, but these days that’s a mere 2.9% of global equity ETF assets.

That tells us that equity ETFs have grown at the expense of active equity funds. It also tells us that investors’ allocation to gold has fallen. If we use the purple line in the above chart, the relative performance of gold relative to the MSCI World Equity Index, it might imply a 5% industry weight would be more reasonable. But we already know that gold is currently under-owned and a contrarian trade.

Physical Gold and Silver

If you are interested in buying physical gold or silver, our recommended bullion dealer is The Pure Gold Company. You can take delivery of your metal in the UK, US, Canada and Europe or leave it in their safe custody. The trading costs are low, while the quality of service is high, as shown on Trustpilot. For more details on The Pure Gold Company, please visit their website.

You won’t have escaped the headlines that the SEC just approved bitcoin ETFs. I want to examine what this might mean for both bitcoin and gold.

The SEC Approves Bitcoin ETFs

The important point that needs to be made is that bitcoin funds have existed for a very long time. Grayscale launched their Bitcoin Trust (GBTC) in 2013 in the US, and XBT Provider launched the world’s first Bitcoin ETF in 2015 in Stockholm (CoinShares since 2016). Today, there are Bitcoin ETFs in Sweden, Switzerland, Germany, Canada, Jersey, Brazil, Australia, Hong Kong, and the USA. There are also listings in places like France, the Netherlands and Dubai. Bitcoin is a global asset, and the US has had GBTC for over a decade, futures since 2017 and a futures ETF since 2021.

The significance of the spot ETF approval is it is the first time an institutional-grade bitcoin product has been approved in the USA. The European ETFs have been excellent and accurately tracked the price of bitcoin less fees for several years. They have provided safe custody and have avoided the scandals found in crypto. Their delayed approval has forced investors to buy workarounds, which have fuelled many of the market frauds and scandals that we have read about in recent years. Had regulators stayed out of the way and allowed the market to choose, the history of crypto would be much less colourful.

For example, bitcoin futures were approved in 2017, but an ETF was not until 2021. When the ProShares Bitcoin ETF finally came about in October 2021, it took $1.04 billion in its first two days, nearly matching GLD in 2004, which took $1.26 billion. These are big numbers.

Then consider that $100 invested in BITO at launch is today worth $53 because the launch coincided with the top of the market at the time. Yet the spot bitcoin sits at $73, meaning regulatory policy (to protect investors) embracing futures ETFs but not spot ETFs cost investors 20% of their capital. And for what?

BITO Bitcoin Futures ETF vs Spot

The good news is that we finally have spot ETFs in the US of A and a clear message, whatever Gary Gensler, SEC Chair, says. Bitcoin is not illegal. Love it or loathe it, you can own it safely in most civilised countries that embrace economic freedoms. The UK, where the ban remains in place, should take note. It is a simple case of prejudice.

The gold or bitcoin question will only grow. You may already know ByteTree’s answer: own both.

But on this significant event, it is worth looking at Graham Tuckwell’s answers to this question from his piece in the Alchemist mentioned earlier. There, “he reflected on responses he has received from gold ETF investors over the years, and feedback he has received on possible Bitcoin ETFs he’s been involved in.”

Are gold and bitcoin similar?

Yes, in some ways. They have a near fixed supply, earn no return, are cheap to hold and are not fiat currencies.

Will gold go more electronic and bitcoin more mainstream?

Yes. They are coming from opposite ends of the spectrum and there will be some convergence and overlapping.

Will bitcoin replace gold as a safe-haven investment?

No. Institutional investors have always wanted allocated gold in their ETFs as it is more secure, and they want to be able to see it is there in the vault. It cannot just be wiped out on a computer screen.

Will both gold and bitcoin be sought after?

Yes, whilst yields remain low to negative and, better still, if interest rates rise and bond prices fall. Maybe a bet on both gold and Bitcoin will work, but for security, a gold ETF for me please.

Gold vs Bitcoin Flows

Having followed gold for 25 years, and bitcoin for nearly 11, I have come to the conclusion that the physical and technological comparisons are tedious and becoming less relevant. As Tuckwell said, “gold go more electronic… They are coming from opposite ends of the spectrum and there will be some convergence and overlapping.”

For me, the behavioural differences are much more interesting. Gold is risk-OFF, while bitcoin risk-ON. Bitcoin is more volatile than gold, and probably always will be, but the gap is closing. Gold is owned by the central banks and widely held as jewellery. Bitcoin is widely owned but in a personal capacity, particularly appealing to the tech-savvy youth. Both are global assets; both are liquid alternative assets, and both provide shelter from fiat currency, which is on its way to a nasty place.

The flows speak for themselves. ByteTree covers these, and the new US ETFs will be added post-launch. The next few days will be crucial. We know GLD, an excellent gold ETF, took $1.26 billion in 2004 on the first two trading days, and BITO, a flawed bitcoin ETF, took $1.06 billion in 2021. What will the new landscape look like? BITO will surely be a loser in this transition.

GBTC will also likely shrink. It is 10 years old and has accumulated 619,187 BTC, more than any bitcoin fund. That was driven by the premium created by regulatory arbitrage (how else could an American buy bitcoin at the time?). The premium ended in 2021, and from then on, it could no longer grow. Investors will be relieved, as the discount, which touched 50% a year ago, has now closed. Investors will be free to sell at net asset value (par) now that it will trade as an ETF.

Grayscale Bitcoin Trust Back to Par

It’s all for grabs as the new issuers want to own the “GLD for ETFs”. Remarkably, State Street is nowhere to be seen. But in the race, we have ByteTree’s BOLD partner, 21Shares, who have teamed up with Cathie Wood at ARK. Naturally, we are egging them on, and no doubt they’ll do well with retail investors. But in the other corner, there’s iShares (BlackRock), who will suck up the big bucks from institutional investors. It’ll be a tough fight, but early post-launch trading volume points to iShares. Quelle surprise.

US Spot Bitcoin ETFs

The gold vs bitcoin flows have favoured bitcoin for several years now, mainly because it started from a low base. But more importantly, bitcoin flows have hit a new all-time high as the funds hold 899,001 BTC. In contrast, the gold ETFs hold 77,104,297 ounces, down 26% from the 106,018,611 ounces held in the summer of 2020. With the hype around bitcoin so great and gold still in the shadows, I suspect this divergence will get worse before it gets better.

It makes little sense that institutional investors are so underweight in gold when it is such an obvious time to own it. But then consider that they already own some gold, albeit not as much as they should, yet near zero bitcoin. This is why this divergence continues.

But where does it settle?

I think this puts things into perspective. ByteTree data shows the gold ETF holdings at $156 billion. Bitcoin fund holdings are a lesser $41 billion.

Perhaps we could simply conclude that bitcoin catches up, implying $115 billion of bitcoin inflows. To put things into perspective, the bitcoin network value (market cap to some) is $937 billion, or after estimates for lost coins, perhaps $750 billion. We know that miners have earned $57.4 billion, which is made up of retained BTC and sold BTC (now spent cash).

The total spend by investors to accumulate the 899,001 BTC, now worth $41 billion, has been around $17.2 bn, so they have made money. We also know that halving comes around in April, taking the supply growth of bitcoin down from 1.8% p.a. to 0.9% p.a. The point is that if bitcoin did catch up with gold, there’s unparalleled buying power ahead. But even then, the high prices would draw out sellers, which shouldn’t be underestimated.

Perhaps a more realistic thought is that we combine bitcoin and gold (there’s a thought) and think about investors’ share of the mix. It leads to a more stable, and quite rational, outcome.

The flows into bitcoin and gold measure demand for both risk-ON and risk-OFF alternative assets. It then becomes a matter of market share. Right now, bitcoin holds a 21% share of the mix. Might it go to 50%? A bit rich, but it’s certainly plausible.

BOLD

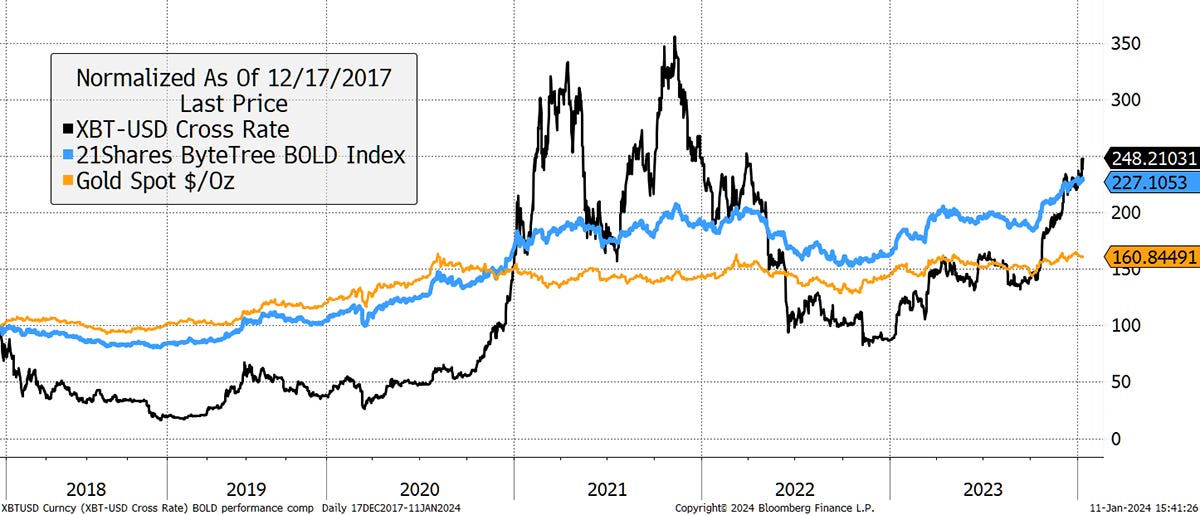

The smart money will follow ByteTree’s lead. They know how to diversify a portfolio, and it’s bitcoin AND gold, not OR. They’ll vote for BOLD because they know that you’ll end up in the same place as you have done since the 2017 high, just without the pain and the volatility.

The Smart Money Will Hold BOLD

Summary

It will be an exciting time for bitcoin and gold. The debate will rage, but I believe they both deserve to be much more widely owned.

Can someone please tell the UK regulator, The Financial Conduct Authority, what’s happening in the real world?

The Gold Dial Remains in Bull Market.