Clean Up with UK Small Caps

The leading global value managers are currently highly focused on UK small-caps because they have been left behind. As a result, we have seen an abnormally high level of takeover activity as foreign investors snap up once-in-a-lifetime bargains. The UK economy is far from strong, but it’s not weak enough to take the blame. For that, we look to things like outdated stamp duty on UK share transactions, excessive regulation, repeated political dramas, super-taxes for North Sea Oil and Gas, net-zero targets, and the general anti-business agenda. Yet despite all of this, the UK smaller companies are world-class and ripe with innovation, creativity, and scope.

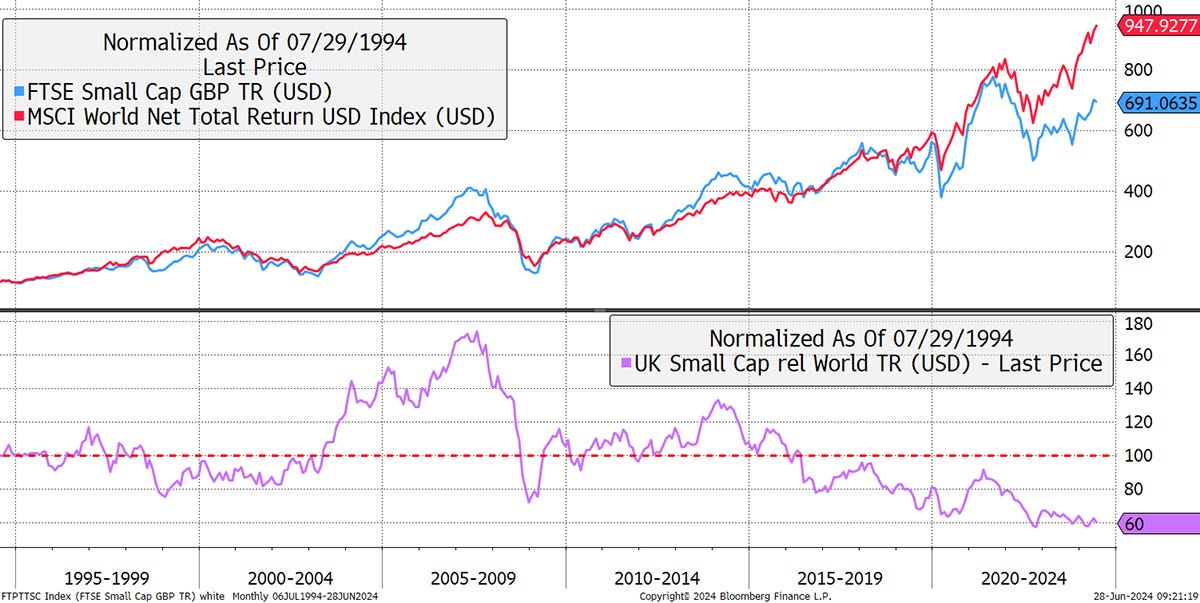

UK Small Caps Relative to the World Total Return in USD – 30 Years

Having been highly correlated with global equities for three decades, UK small-caps have fallen behind. $100 in the world index back in 1994 would be worth $947 today, and in the UK smaller companies, $691. The high point on the purple relative chart was in May 2007. Rebasing the chart to that date shows UK small-caps lagging the world by 65%, which means they need to double to catch up. The good news is that they will.

UK Small Caps Relative to the World Total Return in USD – Since May 2007

In the 32nd issue of Venture, I select a pharmaceutical company that has fallen 68% in recent years despite growing the top line for 20 years in 100 countries and generating strong cashflow. In a rational market, these opportunities should not exist.

Keep reading with a 7-day free trial

Subscribe to ByteTree Research to keep reading this post and get 7 days of free access to the full post archives.