The property market has faced tough conditions in recent years. UK-listed property trades at roughly the same levels as it did in 2005. A property boom preceded the financial crisis of 2008, and the market never quite recovered thereafter. Then came the pandemic, where people worked from home, which was soon followed by the surge in interest rates from low levels.

UK Property Sector since 2003

However, bad news can be good news when it comes to buying stocks because prices are low. What we are starting to see is a shift towards companies demanding employees return to the office, accompanied by a gradual recovery in the demand for office space, alongside firmer rents. The economy may not be on fire, but the commercial property market has likely seen the worst.

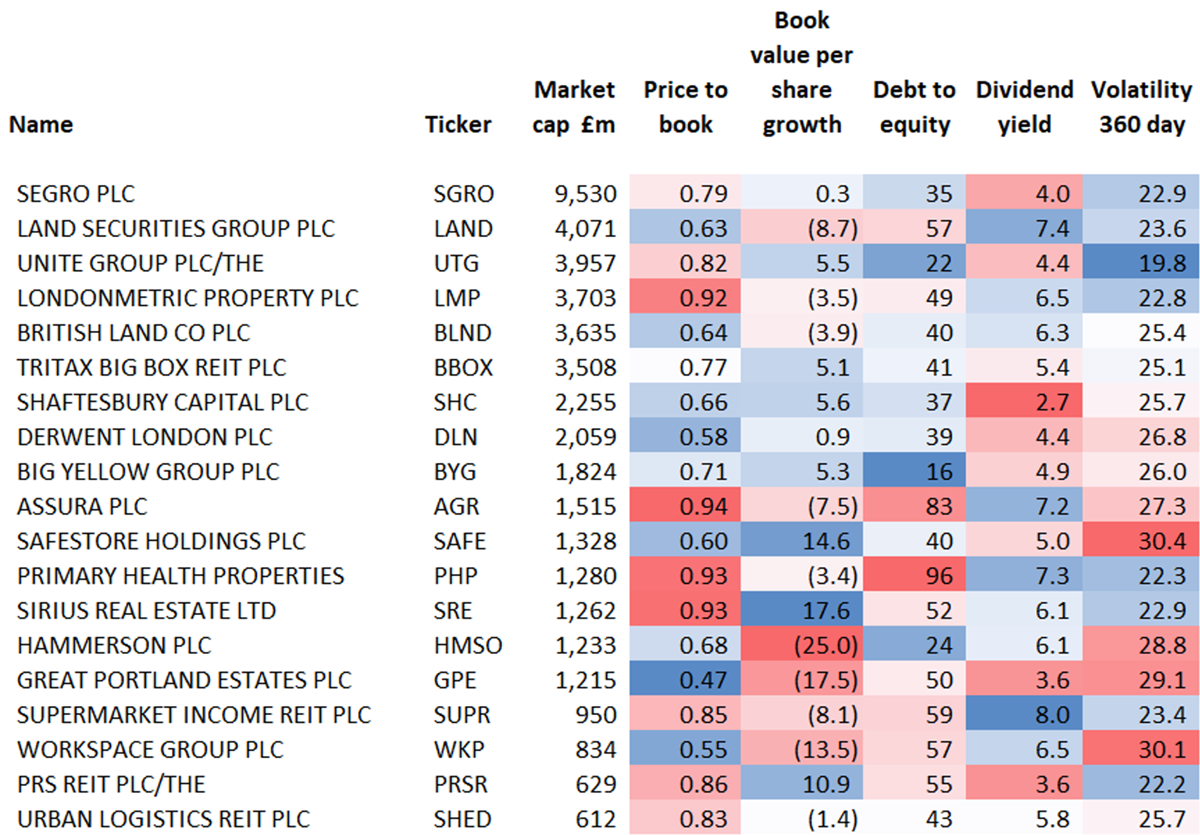

I show the major UK Real Estate Investment Trusts (REITs), all of which are trading below the book value. That means the buildings are worth more than the companies that own them. In the heady days, it’s the other way around, as the shares are worth more than the properties. Business is recovering, yields are attractive, and the sector has calmed down, as seen by lower price volatility.

Major UK REITS

If you’d like to see which REIT caught my eye, please read on.

Keep reading with a 7-day free trial

Subscribe to ByteTree Research to keep reading this post and get 7 days of free access to the full post archives.