The 2020/21 bull market in technology was followed by a spectacular bust the following year. Many stocks were propelled to unsustainable levels and have come back down to earth. The good ones have started to recover, such as Zoom (ZM), while the unlucky, fall by the wayside.

Zoom – The Poster Child of the 2020 Tech Run

I discuss a compelling European software company that has been heavily derated despite delivering on growth.

Datagroup (D6H Germany)

“IT's that simple – when you rely on DATAGROUP

DATAGROUP is one of the leading German IT service providers and supports IT workplaces worldwide for medium-sized and large companies as well as public clients. Around 3,500 employees throughout Germany design, implement and operate business applications and IT infrastructures. With our product CORBOX, we offer customers all the IT services they need for stable IT operations. In short: We manage IT. DATAGROUP grows organically and through acquisitions. The acquisition strategy is characterized above all by the optimal integration of the new companies. With its "buy and turn around" or "buy and build" strategy, DATAGROUP is actively participating in the consolidation process of the IT service market.”

D6H is an acquisitive software company, which has brought together 31 companies since 2006. It high margins and specialises in Germany’s Mittelstand companies. With deindustrialisation, German industry has been going through tough times, but change is coming. The coalition government has collapsed, and an election takes place on 23rd February 2025. The centre-right CDU are favourites, and my German friends are confident that common sense will prevail. It will take time to change, with things like switching the nuclear reactors back on, but the market will take it positively from day one.

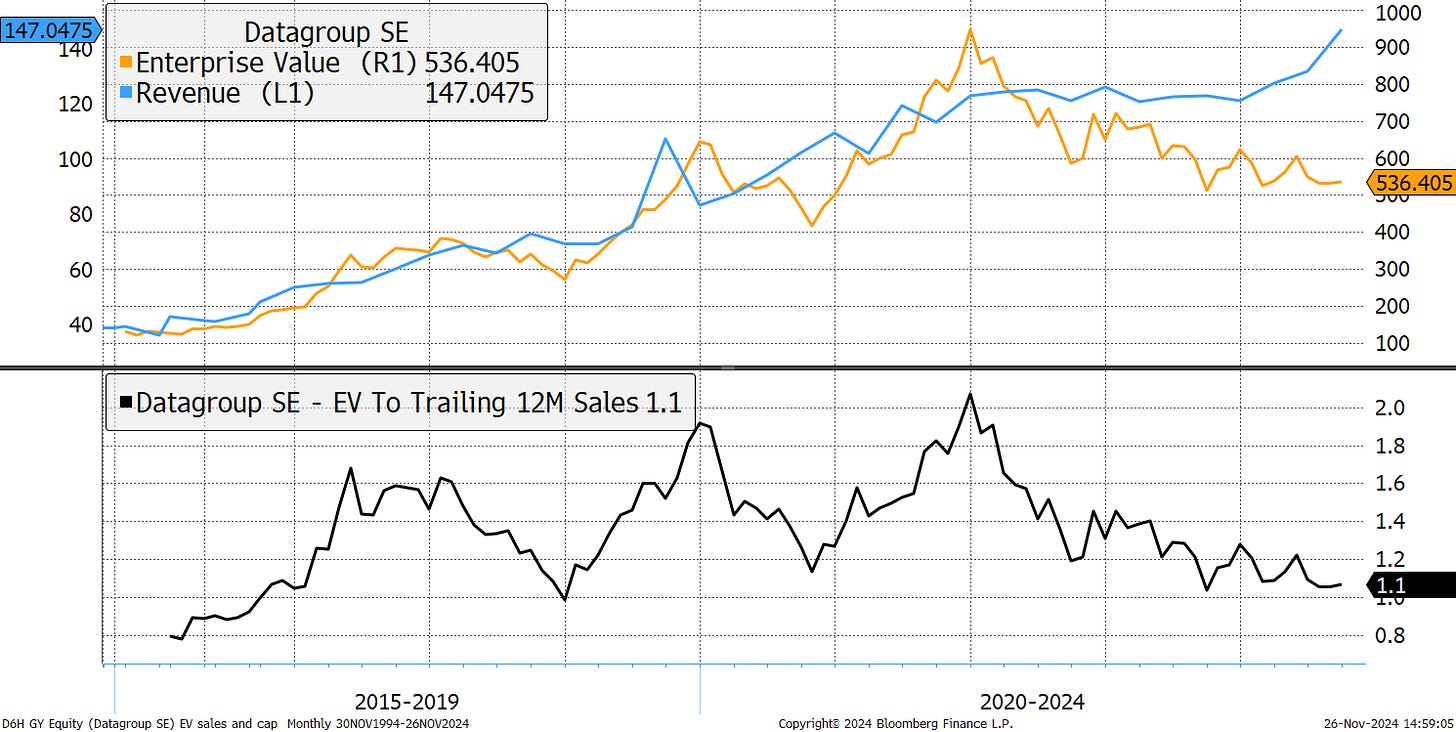

D6H shares ran far too high during the pandemic, and EV to sales is back to levels seen in 2019. This selloff has gone too far, while sales have carried on growing. These sorts of divergences are rare.

DataGroup SE Enterprise Value to Sales

Their primary offering is CORBOX, an IT service portfolio where a company can give them full responsibility in running their IT services. Their contracts are long-term with recurring revenues. They make the point that they work across many sectors and are diversified. They are active in AI, cyber security and the cloud. Many companies say that but D6H have an in-house AI system called HIRO, which conducts “reasoning AI”.

Next year they are Moving to 7th generation of CORBOX, which is a sign of innovation and progress. This investment has recently held back cash flow. In the recent Q3 results, the CEO, Andreas Baresel said:

“What we have done in the last 1 to 2 years is including quite new technologies into the CORBOX like AI, cybersecurity technologies and also new additional multi-cloud technologies, within the orchestration layer to run really seamless multi-cloud services for the customer.”

It was an upbeat note and they reaffirmed guidance for the full year.

D6H is cash generative and has consistently delivered high returns on capital. Capital discipline has been sound with the acquisitions seeing a 49% increase in share issuance, while the asset base has grown six-fold. The shares currently yield 3.3% dividend yield, but in an unusual move, they will cut the dividend in favour of buybacks. Given how little interest there is in UK and European growth stocks, this strikes me as a good move given the shares are undervalued.

It is encouraging that insiders have been buying stock steadily below Eur60, with quite a lot of recent activity.

DataGroup Insider Transactions

There are seven brokers, all buyers with a consensus price target of Eur 77.93 against the current price of Eur 45.25, implying 72% upside. While there have been downgrades since 2022, as the economy slowed, the latest print sees an upgrade.

Broker Consensus

This is a good quality mid cap growth stock with a competitive advantage, and a diversified client base. The election may restore interest in German equities.

Risk

The shares have volatility of around 35% and trade around Eur300k per day. The risks include normal business risk, but I would add that the shares will be most sensitive to future growth prospects. Given it is wedded to the Mittelstand, that makes it political. The balance sheet is strong. I deem this company to be medium to high risk.

Venture Update

Please let me know your thoughts by emailing me at venture@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, Venture

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 CryptoComposite Ltd