Following on from the enterprise value-to-sales ratio (EVS), we move to book value (BV), the price-to-book ratio (PBK) and book value per share (BVPS).

BV looks at a company’s net assets, i.e. the assets less the liabilities. It is most useful for asset-heavy companies, such as property, banks, and industry. It is less useful for asset-light companies, such as software, consumer goods, and support services, yet it still has its merits.

British Land

I show British Land (BLND), which has a UK property portfolio and debt. The blue line, total equity or BV, is an estimate of what the company would be worth if it sold the properties and repaid the debt. I show it against the market cap.

British Land Book Value

Until 2007, BLND’s properties were appreciating in value, only to reverse in the 2008 financial crisis. Interest rates then plunged, and BLND was able to refinance with lower borrowing costs. BV increased again until 2017 before falling into the pandemic. Note how the market cap was higher than BV on the way up and below on the way down. The stockmarket was able to anticipate what was coming.

British Land Book Value and Price-to-Book

I have added the price-to-book (PBK) in purple. That takes the market cap and divides it by the BV. BLND has a market cap of £3.5 bn and a BV of £5.3bn. Therefore, the PBK is 0.62x, as shown in the above chart.

In theory, you could buy the company, sell the assets and make a profit, but for whatever reason, no one has done it. That is probably because a takeover would need to pay book value, or else the shareholders and the board would reject the offer.

The valuation is indicative of the fact that the property market remains soft. Notice how the 20-year average PBK is 0.8x, and so for BLND, trading below BV, i.e. at a discount, has become the norm. That said, in the late 1990s and before the financial crisis of 2008, BLND shares were trading significantly above book value, i.e. at a premium. During those times, investors were willing to pay more for the property portfolio than it could be sold for at the time. In the late 90s, that was well-founded because the property market continued to do well over the next decade. But in 2007, it proved to be a disaster.

In 2008, BLND was in trouble, and the company had to raise new capital by issuing shares. In the late 1990s, the company issued shares at a premium, which enhanced shareholder value because they were able to buy property at 100 while selling shares at 130 to pay for it. The share sale in 2008 took place at a discount, and BLND was selling shares at a discount.

British Land Shares Outstanding (Rebased to 100)

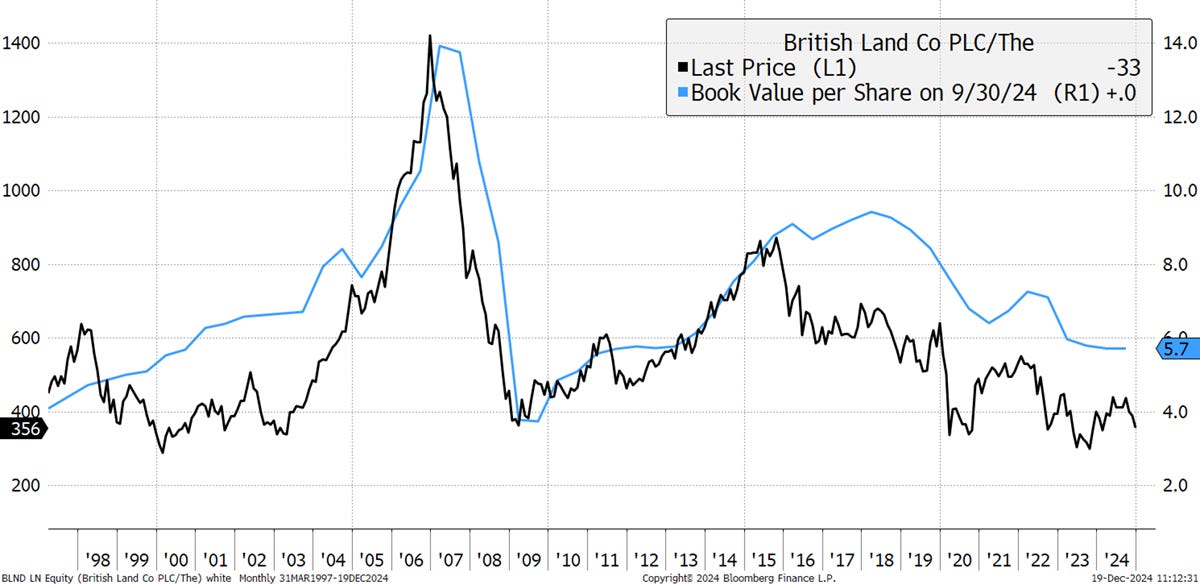

With property price movements, debt refinancing, share price movements and share issues, it soon gets complicated. That brings us to book value per share, which I show against the share price. The chart gets us back to where we started, with the advantage of seeing everything on a per-share basis. That is a clear measure of what each share has gained or lost, in terms of assets, over the period. In 1997, BLND shares had 410p of BVPS and today 570p. That’s a 40% gain, while the shares have fallen by 13%. BLND shares have cheapened.

British Land Book Value per Share

BLND shareholders may have seen a lower share price, but the dividends boosted returns. Dividends boosted returns to 141% over the period, or 3.2% per annum. That is approximately half of the return of the FTSE All Share Index.

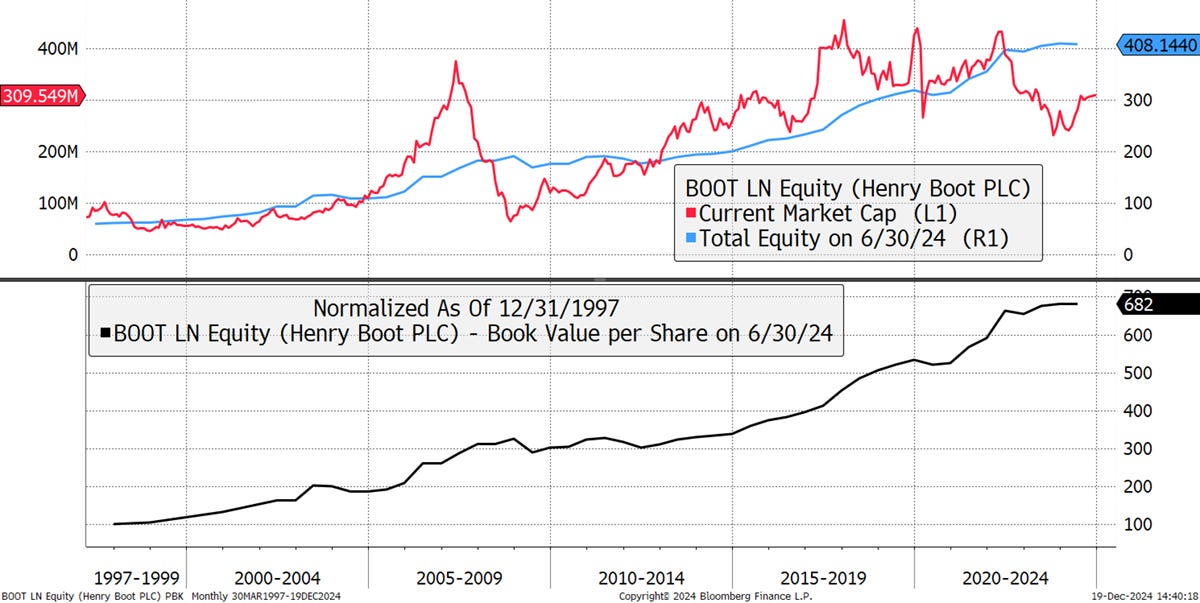

Henry Boot

BVPS is a useful measure, not just for comparing attributable value to the share price, but to see how the company has added value over the long term.

Henry Boot (BOOT) is a family-controlled, UK small-cap held in ByteTree Venture, and is involved in property development and construction. It faced the same pressures as the other property companies yet kept debt levels low, so it managed to avoid going backwards at times of stress. It has consistently added to the asset pot, growing BVPS six-fold 6x over the period shown. Over the period, and with dividends, the shares have gained 8.3% p.a., which is 3% higher than the FTSE All Share, and the shares trade below book value.

Henry Boot Book Value per Share

Carnival

The cruise company Carnival (CCL) was doing well up until the pandemic, as they added new capacity without raising debt. Then came the pandemic, and their business shut down. They had to raise new capital from shareholders in a rights issue, more than doubling the number of shares outstanding, and take on more debt. The results saw a collapse in the BVPS and the share price.

Carnival Raised Debt

In the past, CCL traded well above BVPS and has consistently added value. No doubt the company gets back on track, but investors have priced that in. Today, the shares trade on 3.7x PBK against a 20-year average of 1.7x. There is the possibility that the book value is understated due to US accounting rules, but that would not be significant in this case. It could also be that investors are overpaying, yet other value measures, unrelated to book value, are not wildly out of line. In this case, it is likely that investors believe CCL will pay down its debt quite quickly now that the business has recovered from the pandemic.

Carnival Price-to-Book Ratio

Simon Property Group

I mentioned US accounting, which treats book value differently. Unlike UK accounting, where assets are revalued in the accounts, US accounting books them at their purchase price. That means if they hold an asset for a long period of time, the book value becomes meaningless. I show one of the leading US real estate investment trusts (REIT), Simon Property Group (SPG US). The book value is a mere $3.3 bn when the company is valued at $56 bn, putting it on a PBK of 21x, which contrasts with BLND on 0.6x. Yet SPG isn’t overvalued; instead, its BV is understated. In the company’s accounts, they quote the total equity value at $53 bn, meaning the company is valued close to net asset value. This is something to be aware of when looking at US companies when using book value.

Simon Property Group Book Value

Berkshire Hathaway

Leaving things on a positive note, I show Berkshire Hathaway (BRK US), Warren Buffett’s company. He has consistently increased the BV of BRK, and it is a more accurate measure than for SPG because the assets are periodically realised.

The insurance operations, which hold cash and bonds, will frequently be updated at fair value, along with the equity sales, such as the gains from their investment in Apple (AAPL US), as will the $325 bn cash pile. Yet the private companies, such as BNSF Railway and Geico Insurance, and things like their stake in Coca-Cola or American Express (AXP US), which have been held for decades, will still be counted at their purchase price. This would be far below their current value, and financial analysts will account for this when assessing BRK’s fair value.

Even with US accounting, the growth in book value has been impressive, increasing BVPS by 23x since 1996. The current valuation is 1.53 PBK, against a historical average of 1.4x. Buffett has previously bought back shares at 1.2x, believing them to be too cheap, but has not committed to that level. This is an indication that he believes 1.2x is undervalued, implying that it would be a good level to buy BRK.

Berkshire Hathaway Book Value

Summary

Book value is a measure of a company’s assets and is less used these days in financial analysis, especially in the USA. Yet, in financial companies, including banks, insurance, and property, it can be very useful indeed. It is also useful in asset-heavy industries and as a measure of value added by company management using BVPS.

It can even be useful in asset-light companies, such as the retailer JD Sports (JD). In the below chart, you can see that the management has done a good job in creating shareholder value with the growth in BVPS. You can also see that it traded with an average PBK of 2x between 2003 and 2013 before elevating to 6x thereafter. Now it’s back to 2x - does that make it cheap today?

JD Sports Price to Book Value

To answer that, we need more information, and it sends an equity analyst on a journey to understand why. The next steps are to look at the state of the balance sheet, the cash flow, the margins, growth, and more.

When evaluating a company, no single financial metric can be used in isolation. You need to find the relevant ones for the situation at hand and apply them objectively. Book value, price-to-book, and book value per share are old-school, but I wouldn’t want to be without them.

In the My Journey in Finance series, ByteTree Founder Charlie Morris shares some of the lessons learned during his three-decade-long professional career in finance and investing.

We would love to hear your feedback, so please share your thoughts in the comments. It would really help us if you could like, restack/share this update and subscribe to our Substack. Thank you so much for your support!