Following rebalancing on 30th May 2025, the new target weights for the BOLD Index are 29.8% Bitcoin and 70.2% Gold, a 1.7% increase for Bitcoin over the previous month. Once again, as Bitcoin’s volatility remains stable and Gold’s volatility increases, the BOLD Index has increased exposure to Bitcoin at the expense of Gold. This is Bitcoin’s highest-ever target weight in the history of the BOLD Index.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 28.1% and 71.9% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 30.9% Bitcoin and 69.1% Gold. This means the latest rebalancing has seen 1.1% added to Gold and reduced from Bitcoin to meet the new target weights.

BOLD Performance

In May, BOLD rose by 3.0%, Bitcoin rose by 12.3%, and Gold was flat, while global equities rose by 5.5% in USD terms. The US dollar was down 0.1%.

Bitcoin, Gold, BOLD, and Equities in USD – May 2025

Over the past year, BOLD has returned 51.9%, while Bitcoin has returned +71%, in contrast to Gold with a +43.9% gain, while equities have risen by +16.3%. It is notable how Bitcoin and Gold have broken away from US equities.

Bitcoin, Gold, BOLD, and Equities - Past Year

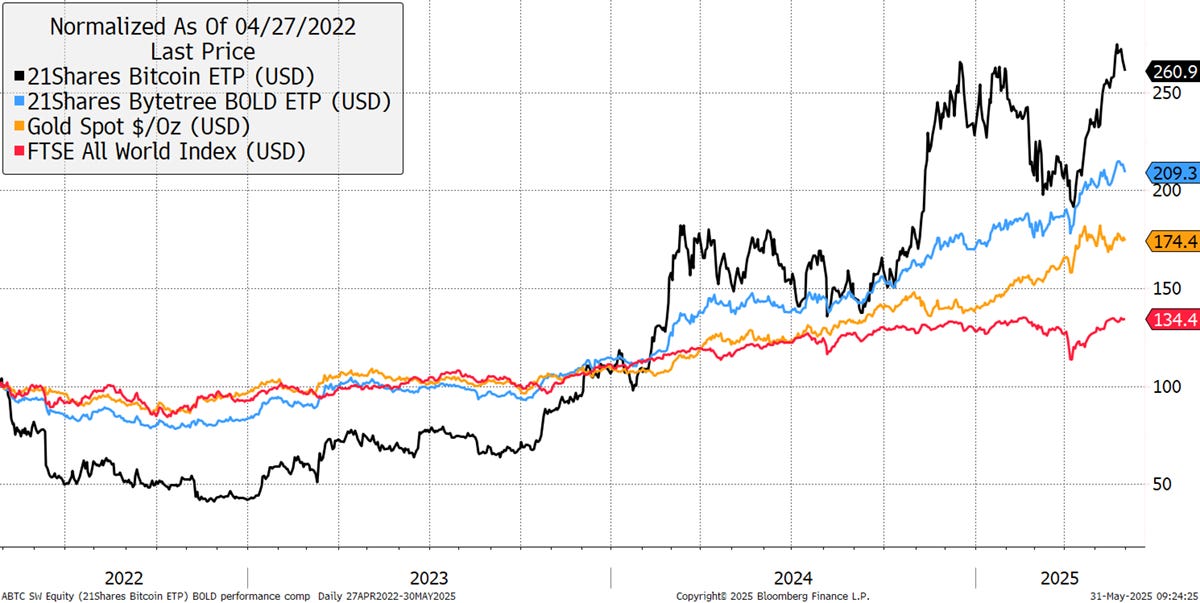

Since the 21Shares ByteTree BOLD ETP’s inception on 27th April 2022, BOLD has returned +103.3%, Bitcoin has returned +160.9%, Gold is up +74.4%, while equities have risen by +34.4%.

Bitcoin, Gold, BOLD, and Equities - Since Inception

US Treasury Crisis Drives Bitcoin and Gold

Government bond markets are in crisis. Debt levels are too high, and governments are being squeezed by the cost of servicing their debt. This has pushed bond yields higher as the market struggles to cope with the vast levels of new debt issuance.

However, there is another explanation for the bond yield, and that comes from growth, or more specifically, nominal growth, the combination of real growth and inflation. This is known as the Wicksell Rule, where the nominal growth rate should roughly equal the 10-year yield. For the first time since the pandemic, and after huge financial disruption, this is once again true. The bond yield at 4.2% can also be explained by the level of nominal GDP growth.

The Wicksell Rule - US Treasuries and Nominal GDP Growth

Notice that in the 1970s, we were in an era of financial repression where the 10-year was below nominal GDP. This brought the debt burden from WWII down to low levels. That was repeated after the 2008 financial crisis but came to an end during the pandemic. The debt surged, along with inflation, which caused the service costs to escalate rapidly. The solution was to raise interest rates to maintain confidence in the bond market and fight inflation. The trouble is that to reduce government debt by inflation, the yield needs to fall, or the level of growth needs to rise.

The US administration is trying to boost the real growth part of nominal growth and contain inflation to try and restore financial repression. This is the only way to reduce the debt burden in the long term.

What is most interesting for Bitcoin and Gold watchers is how the 10-year yield is driving the price of Bitcoin vs Gold. This has always been true to an extent, as rising yields generally reflect growth, and falling yields a slowdown. Gold is risk-OFF and prefers falling yields. Bitcoin is risk-ON and prefers rising yields. The relationship has tightened considerably.

The Impact of Bond Yields on Bitcoin and Gold

Not only do we have ETF flow data (see below) to help understand the Bitcoin vs Gold relationship, but now we can confidently point towards the bond yield.

BOLD watchers don’t need to worry much about bond yields because it seems either Bitcoin or Gold is doing the heavy lifting at any time. We shouldn’t mind which, but it’s nice to know that the bond volatility works in BOLD’s favour.

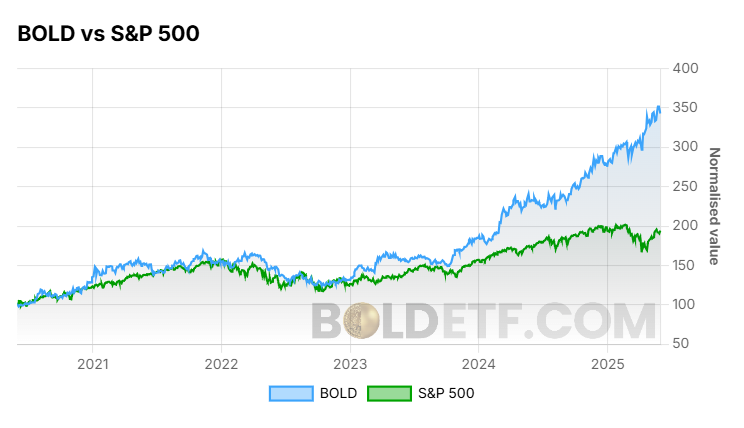

BOLD vs S&P 500

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

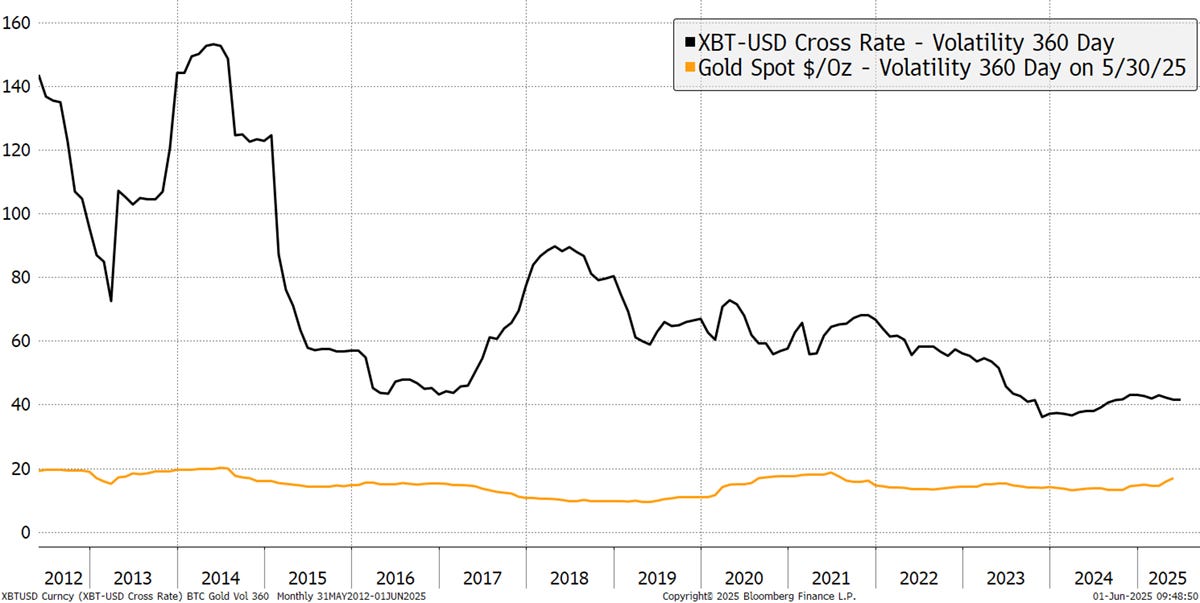

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 39.2% and 16.6%, respectively. Bitcoin’s 360-day volatility has fallen by 1.0% over the past month, and Gold’s has risen by 0.9%. This is a continuation of what happened in April, and the gap between Bitcoin’s and Gold’s volatility is historically narrow. This has led to the highest Bitcoin weight on record for the BOLD Index.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility were ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 29.8% for Bitcoin and 70.2% for Gold, using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold. This recent weight has opened up a new range, with Bitcoin gaining further progress.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Bitcoin: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, like it did in February, it would be boosted back up to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

This rebalancing is also a source of excess return. The red line shows Bitcoin’s and Gold’s performance at the weights in April 2022 to date. The excess return of BOLD (after fees) has been 19.5% since the ETP was launched. Rebalancing transactions pay, and nowhere more so than in Bitcoin and Gold.

BOLD Rebalancing Has Added 19.5% over 3 Years

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and is a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold

Bitcoin and Gold ETF Flows

ETF flows have been favouring Bitcoin in April and May, but that has turned back in favour of Gold over the past week.

It is notable that the total value of Bitcoin and Gold ETFs has surpassed $450 billion.

Bitcoin and Gold ETFs AUM

Please subscribe to our Substack to receive monthly updates on BOLD.

Additionally, please visit BOLDETF.com, which is full of data and charts to help investors better understand the benefits of the strategy.

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow. The fund now holds $26.5 million of Bitcoin and Gold held in safe custody, with Copper for Bitcoin and JPMorgan for Gold. It trades actively in CHF, EUR, USD, and GBP in Switzerland, Germany, the Netherlands and France. The ticker is BOLD.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.