Following rebalancing on 31st October 2024, the new target weights for the BOLD Index are 24.6% Bitcoin and 75.4% Gold, broadly unchanged since last month.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

In October, BOLD rose by 5.9%, Bitcoin rose by 9.7%, and Gold rose by 4.2%, while global equities fell by 2.0% in USD terms. The target weights last month were 24.6% and 75.4% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 25.8% and 74.2%. This means the latest end-October rebalancing has seen 1.2% reduced from Bitcoin and added to Gold to meet the new target weights.

Bitcoin, Gold, BOLD, Equities USD – October 2024

Understanding What Drives BOLD

Blending Bitcoin and Gold on a risk-weighted basis leads to a more favourable outcome than Bitcoin or Gold alone. Shortly after the pandemic, Gold made an all-time high on 7th August 2020, where the chart begins. The price of Gold didn’t make a new high until March 2024. Yet BOLD made a new high in the autumn of 2020 and again in October 2023, five months before Gold’s high in March this year. The lower black chart shows how BOLD has outperformed Gold by 68% since the start.

BOLD Versus Gold

The same is true for Bitcoin, which made a notable high on 12th November 2021, where the below chart starts. Bitcoin collapsed by 75% into 2022, whereas BOLD’s maximum loss was 25%. BOLD’s new high occurred in October 2023, again six months earlier than Bitcoin’s in March 2024. BOLD continued to make more new highs, and today, it is 56% higher than at the start, in contrast to Bitcoin, which is up 6%.

BOLD Versus Bitcoin

The lower purple chart shows BOLD relative to Bitcoin, which has outperformed by 47%. There can be no doubt that Bitcoin will beat BOLD in a Bitcoin bull market, but BOLD seems to hold the fort, providing shelter from Bitcoin’s volatility.

In other words, BOLD has beaten both Bitcoin and Gold over the periods since their last major all-time highs. It has achieved this through risk-adverse allocation and monthly rebalancing transactions, which repeatedly add to the weaker asset and take away from the stronger asset.

I compare BOLD to Bitcoin in Gold (red), which is currently 25 ounces. That is, one Bitcoin is worth the same as 25 ounces of Gold. The success of BOLD has been most notable when Bitcoin has outperformed Gold, but not always. These past six months have seen BOLD rise strongly when Bitcoin has been weak. In recent weeks, the strong seasonality for Bitcoin has kicked in, and unusually, both assets are performing well simultaneously.

What Drives BOLD

Unsurprisingly, BOLD is often a smoothed version of Bitcoin in Gold, missing out on the peaks but, crucially, also the troughs.

BOLD Performance

Over the past year, Bitcoin’s performance has returned +101.8%, in contrast to Gold with +38.3%, while equities rose +31.7%. BOLD has returned +56.3%.

Bitcoin, Gold, BOLD, Equities - Past Year

Since the BOLD ETP inception on 27th April 2022, Bitcoin is +83.4%, Gold +44.0%, and equities +29.7%. BOLD has returned +64.2%.

Bitcoin, Gold, BOLD, and Equities – Since Inception

October Rebalancing of the BOLD ETP

BOLD allocates Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 41.7% and 13.6%, respectively. In 2024, Bitcoin has seen a modest increase in volatility compared to Gold, as shown by the purple line above.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 24.6% Bitcoin and 75.4% gold using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset using volatility. In 2017 and 2018, simulated BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which stood it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range.

In recent years, the monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. This was not true in 2016/17 when Bitcoin saw the price surge, but it has been an effective tailwind as Bitcoin has matured as an asset, making the BOLD strategy highly relevant today.

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, then at the end of the month, it would be boosted to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce the Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and is a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold and Diversified Equities

ByteTree Research on Bitcoin and Gold

At ByteTree, we publish monthly publications on Gold in Atlas Pulse and Bitcoin in ByteFolio, which also covers our crypto research.

In the latest issue of Atlas Pulse, Glitter or GLTER, I looked at the expected return framework from the World Gold Council, which has tackled Gold’s long-term “expected return” (GLTER).

The expected return is a long-term forecasting method for the returns of an asset class. Traditional financial assets, such as bonds and equities, have widely accepted expected return frameworks, and until now, Gold has been the exception. Pension funds use expected returns to better understand their long-term assets and liabilities. That makes this work important because an asset with an accepted expected return framework is more likely to be recommended by the investment consultants than one that isn’t. In other words, a well-laid-out investment framework could lead to new demand for Gold from institutional investors.

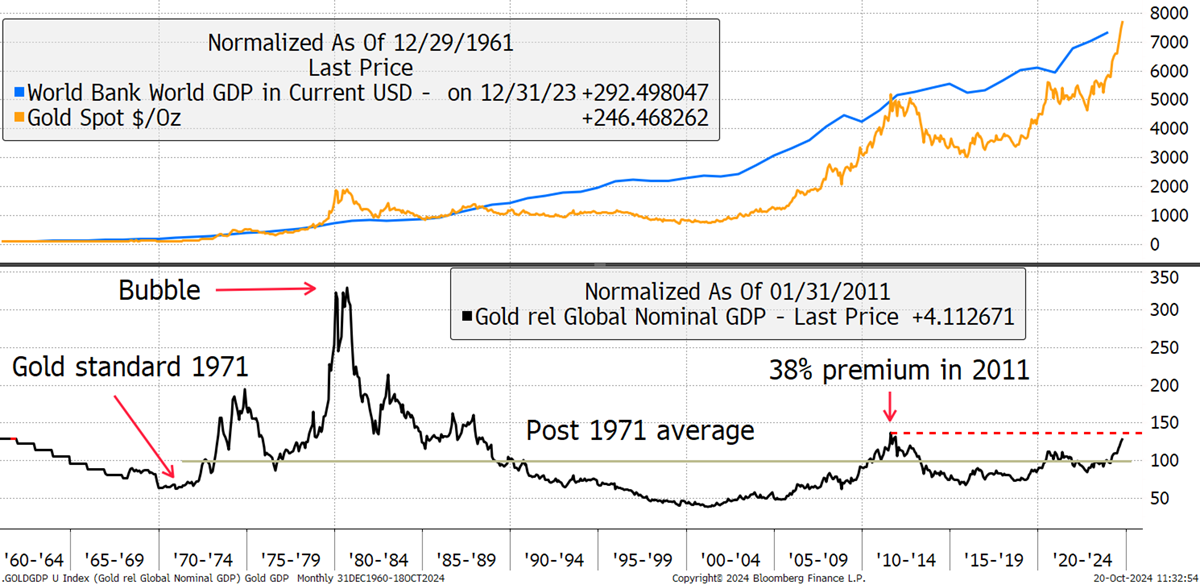

I show global nominal GDP data (blue) since 1960. GLTER insists we don’t start the clock until 1971, when the gold standard came to an end.

Gold and Global Nominal GDP

The Gold price and GDP have been mean-reverting (black), which is encouraging. I have calibrated the average post-1971 to 100, and on this basis, we are 28% ahead of the average. But it’s early November, and you can deduct 4% or 5% for 2024’s GDP which will turn up when the OECD next updates the data. According to GLTER, the Gold price is ahead of itself, but not massively so.

ByteFolio

In ByteFolio, Meet the Resistance, I looked at the current trading range, first seen in 2021. The Bitcoin price has spent remarkably little time up in this range following the two short-lived attempts in 2021.

The Bitcoin Resistance Zone

At $70k BTC, the cost of maintaining the network is $11.5 billion per year. That is, the miners receive 450 BTC per day, so it is cheaper to reward them at lower prices than at high prices. Following the halving in May 2024, it costs half as much to support a higher Bitcoin price, which explains why Bitcoin has spent much more up here since the halving than before. Higher prices are possible, but that would require commensurate flows.

Summary

It has been a good run for both assets, and it may well be that they take a break. But what seems to keep on happening is that the larger the deficits grow, and with that, nominal GDP, the more BOLD responds.

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.