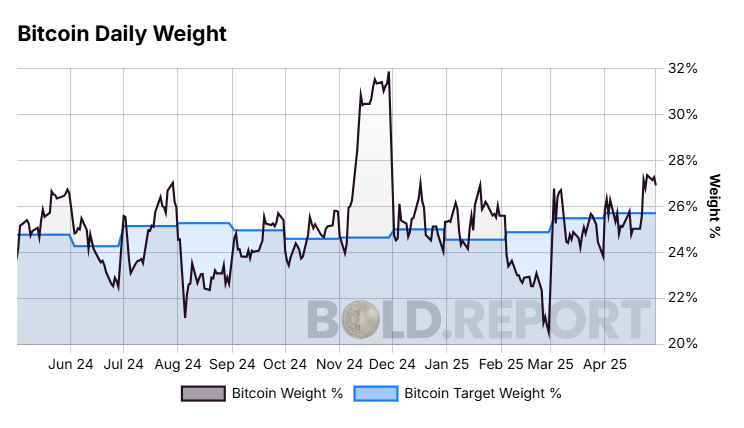

Following rebalancing on 30th April 2025, the new target weights for the BOLD Index are 28.1% Bitcoin and 71.9% Gold, a 2.4% increase for Bitcoin over the previous month. This is Bitcoin’s highest-ever target weight in the history of the BOLD Index.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 25.7% and 74.3% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 27.3% for Bitcoin and 72.7% for Gold. This means the latest rebalancing has seen 0.8% added to Bitcoin and reduced from Gold to meet the new target weights.

Three Years Since the IPO

On 27th April 2022, a time when Bitcoin was in a bear market, and investors were losing interest in Gold, we took the opposite view and saw it as a good time to launch BOLD on the SIX Exchange in Zurich, Switzerland. In the photo, I marked the occasion by ringing the cowbell when the market opened at 9 AM. Standing next to me on the left is Alistair Byas Perry, Head of Capital Markets at 21Shares AG.

Since that time, two things have changed. Firstly, Gold is beating the S&P 500 by quite a wide margin.

Gold and the S&P 500 – Past 3 years

Recall that investors had been heavy sellers of the Gold ETFs until June 2024. What many still don’t realise is that investors have reduced their Gold holdings by nearly 15% since the 2020 peak. Gold is still a somewhat contrarian trade because “Wall St” is heavily underweight.

While Gold has run ahead of the S&P 500, Bitcoin has run ahead of the Nasdaq. The launch of US ETFs in early 2024, combined with block halving in May 2024 and the Trump Victory in November, boosted sentiment. Bitcoin has done well over the period shown but is yet to be embraced by the mainstream. Not only are investors underweight Gold, but they barely own any Bitcoin at all.

Bitcoin and the Nasdaq – Past 3 years

BOLD has been a hugely successful investment strategy, mainly because Bitcoin and Gold have performed well. To my mind, that was always very likely to happen, but I didn’t know when the great rotation would start. More important to me is the resilience of the BOLD strategy. Many investors hear the investment case for these highly liquid, complementary alternative assets, Bitcoin and Gold, and simply hold both. The advantage of BOLD over that approach is that simply holding Bitcoin and Gold misses the mechanism quietly working in the background, making BOLD investors even more money.

Each month, the volatility sets the asset allocation and then rebalances the portfolio by buying low and selling high. After 36 rebalances, you can see that the 21Shares ByteTree BOLD ETP (blue) rose by 103.3%, whereas a zero-fee portfolio of Bitcoin and Gold, using the same start weights, lagged by 17% or 5.5% p.a. The fees, a mere 0.65%, were clearly worth it as they added 5.5% of value each year.

BOLD Versus Bitcoin and Gold

This is a massive win for BOLD and demonstrates the added value in the live ETP over the past three years. The strategy works because Bitcoin and Gold naturally have a low correlation. That means when one is up, the other is often down. This is a powerful combination that results in much lower portfolio volatility (risk) than might be expected.

It has been highly rewarding to see BOLD deliver such high returns. I thank all our investors, who have, in many cases, crawled over hot coals to support our product. I very much hope it is easier in the next three years to invest in BOLD than it has been in the last.

On Sunday, it had been three years since the IPO. We shouldn’t be that surprised that BOLD has performed so well over the period because the strategy has been consistent over ten years.

BOLD vs Nasdaq

The most rewarding part, as you will see later in this piece, is the extremely low volatility. Not only has BOLD done well, but it has beaten Bitcoin and Gold held independently and done so with a modest level of risk. This combination is unparalleled and something we can all be proud of.

BOLD Performance

In April, BOLD rose by 8.9%, Bitcoin rose by 12.9%, and Gold rose by 6.0%, while global equities rose by 0.2% in USD terms. It is notable that the dollar fell by 4.5% in April.

Bitcoin, Gold, BOLD, and Equities in USD – April 2025

Over the past year, BOLD has returned 47.5%, and Bitcoin has returned +52.3%, in contrast to Gold, with a +45% gain, while equities have risen by +9.3%. It is notable how Bitcoin and Gold have broken away from US equities.

Bitcoin, Gold, BOLD, Equities - Past Year

Since the inception of the 21Shares ByteTree BOLD ETP on 27th April 2022, BOLD has returned +103.1%, Bitcoin has returned +132.3%, and Gold is up +75.5%, while equities have risen by +27.7%.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

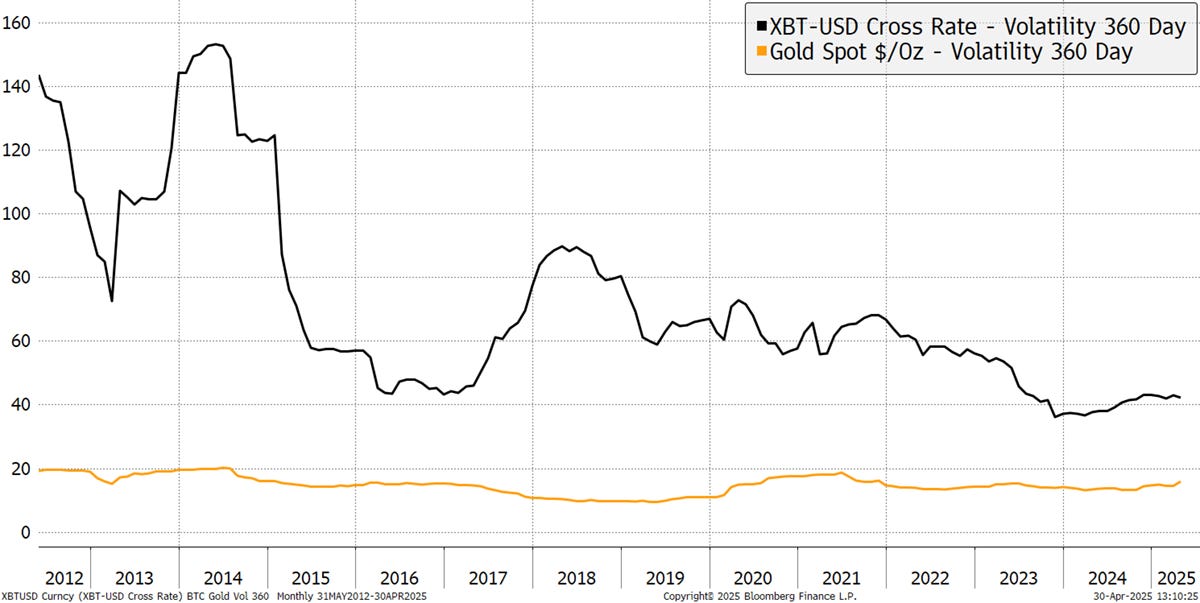

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 40.2% and 15.7%, respectively. Bitcoin's 360-day volatility has fallen by 0.5% over the past month, and Gold’s has risen by 1.6%, the largest rise since 2020. This explains the material increase in the Bitcoin target weight to the highest level on record.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 28.1% Bitcoin and 71.9% Gold using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold. This recent weight has opened up a new range, with Bitcoin gaining further progress.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy-and-hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Bitcoin: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, like it did in February, it would be boosted back up to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold

Bitcoin and Gold ETF Flows

ETF flows have been notable for Gold this year, but we have just witnessed the first weekly outflow.

In contrast, Bitcoin flows have recovered from the weak patch seen in February and March.

Combining Bitcoin and Gold flows demonstrates that they are counter-cyclical. Just as Gold flows are turning down from high levels, Bitcoin flows are turning up. This pattern keeps being repeated as both assets take turns in the leading role. This behaviour is key to the success of the BOLD Index.

Bitcoin and Gold ETF Inflows in USD

Please subscribe to our Substack to receive monthly updates on BOLD.

Alternatively, please visit BOLDETF.com, which is full of data and charts to help investors better understand the benefits of the strategy.

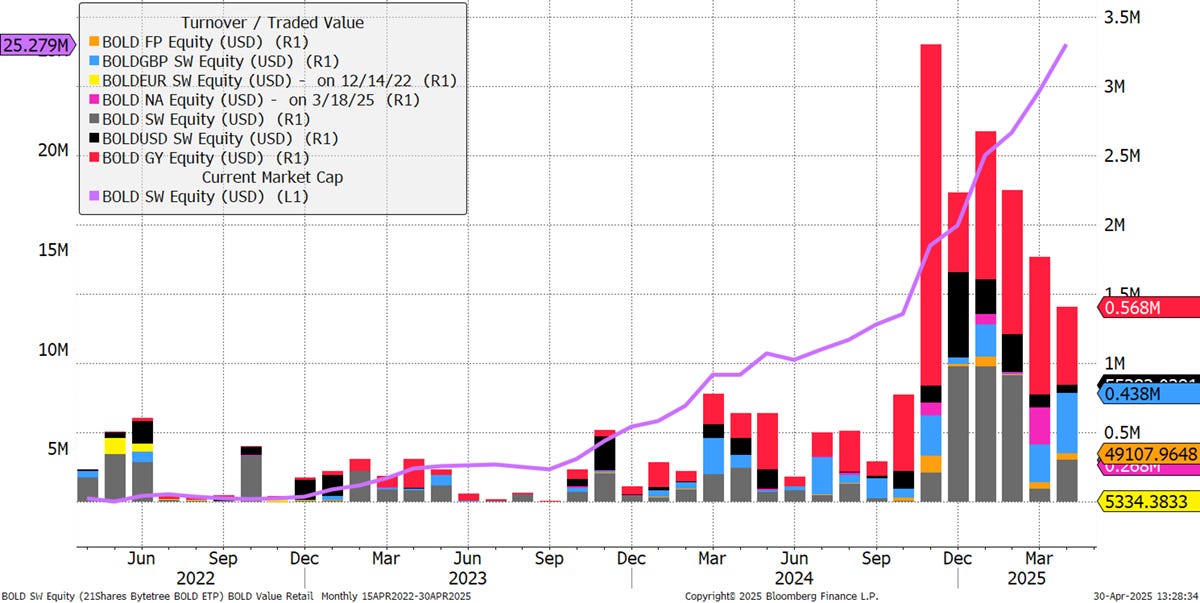

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow. The fund now holds $25.3 million of Bitcoin and Gold in safe custody, with Copper for Bitcoin and JPMorgan for Gold. It trades actively in CHF, EUR, USD, and GBP in Switzerland, Germany, the Netherlands and France. The ticker is BOLD.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Hi John, I hope we can help US investors in due course. In teh meantime, you can follow the weights and get a good outcome. https://bold.report/bold/weightings

when do we get to buy this in the USA