As a matter of record, I publish performance data for the two portfolios in the Multi-Asset Investor, Whisky and Soda, for Q1 2025. With Trump’s tariffs announced on Thursday, 2 April, much has happened over the past two weeks, making Q1 a distant memory of market calm. Regardless, I shall report performance for Q1, and I will address Q2 in July.

Key Points in Q1 2025

Europe and the UK made gains in Q1. Emerging markets were flat. Japan fell slightly, while the US market fell by 8%.

Gold rose by 15% in GBP as uncertainty grew.

The dollar fell by 4%.

Bonds continued to come under pressure as the long-dated gilt yield brushed with all-time highs.

Technology and consumer discretionary stocks fared worse, with energy holding up. In Europe, the banks were strong.

Small and mid-cap stocks lagged large caps.

Global Equities in Q1 2025

The Multi-Asset Investor is a diversified portfolio service that blends traditional bonds and equities with alternative assets such as gold, commodities, and bitcoin. It combines two portfolios, Soda and Whisky.

Soda

A long-term, low turnover portfolio investing in diversified large cap stocks, funds, exchange-traded funds (ETFs) and investment trusts.

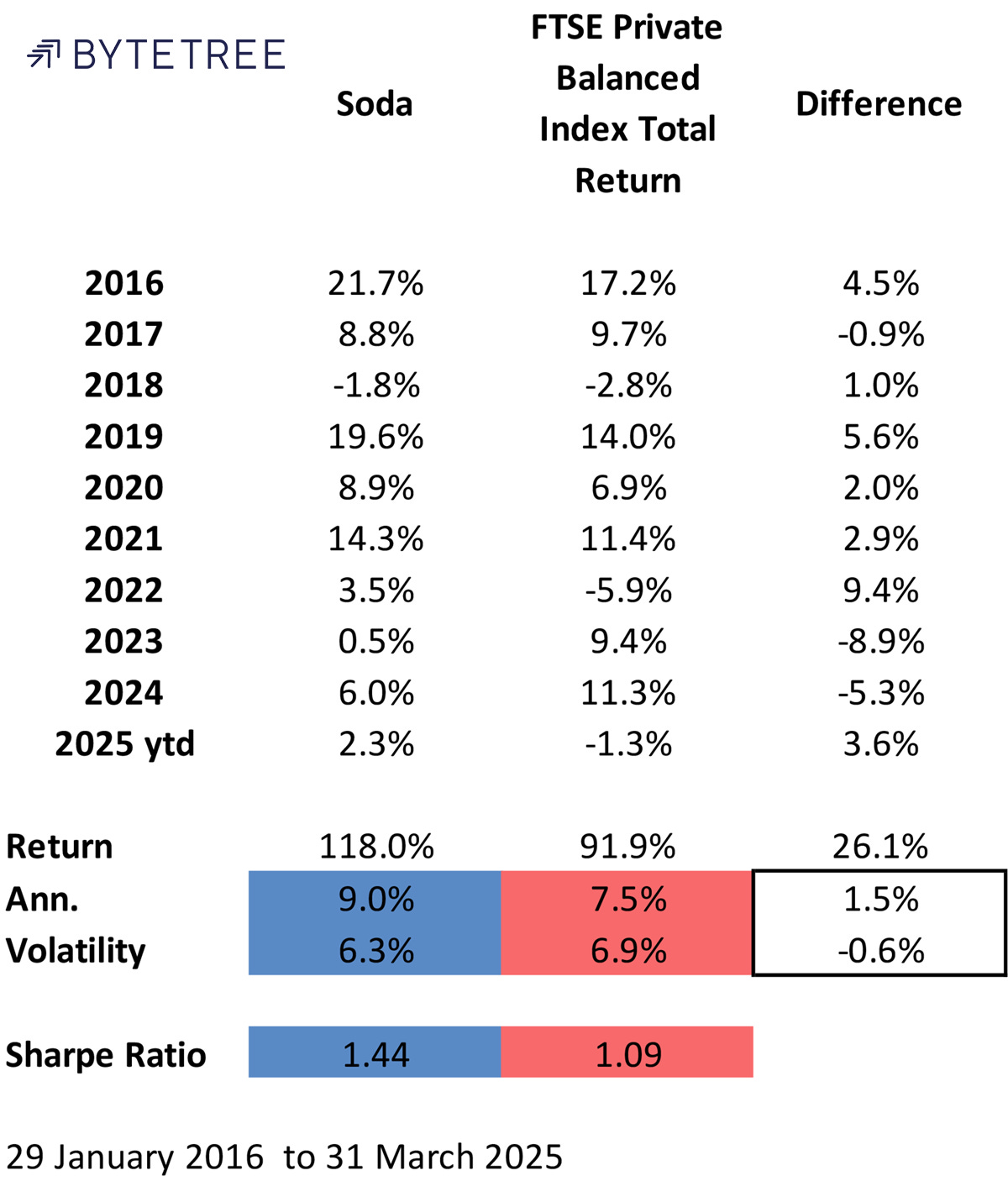

The Soda Portfolio has remained defensive compared to the FTSE Private Balanced Index, a 60% equity, 40% bond benchmark for private investors. In Q1 2025, Soda returned to 2.3% against a 1.3% fall for FTSE Balanced. The index is heavily exposed to US equities, which Soda is not. Avoiding those highly valued areas of the market helped relative performance. Soda also holds gold, which performed well.

Soda vs FTSE Private Balanced Index

As the investment landscape remains volatile and uncertain, I believe it will be right to remain defensive. The Soda Portfolio, although measured against a 60/40 benchmark, has a very different portfolio makeup. It has a quality and value bias, making it more resilient during difficult times. I have consciously avoided the many areas of high valuation in markets, which caused the portfolio to lag the index in 2023/4, but I believe the jaws will now widen again. The potential for overpriced, large stocks to remain weak for many years will provide an easier path when comparing performance against the market.

Soda Performance

The portfolio holds assets based upon their merits rather than their place in the index. That will become essential as the global trade wars threaten a global recession. In recent years, passive investing has become ever more popular. The major indices, such as the S&P 500, are now heavily concentrated with expensive stocks, and their potential to disappoint should not be underestimated. Soda will continue to identify excellent managers and allocate to profitable opportunities.

Whisky

A tactical, actively traded portfolio investing in mid to large cap stocks in developed markets, investment trusts, global ETFs and bitcoin.

In Q1 2025, Whisky returned 6.8%, narrowly beating the FTSE 100, which returned 6.1% after including dividends. The portfolio was largely UK and European, with additional exposure to Brazil, Chinese technology and the Middle East. There was a bias towards financials, with a large position in the gold miners and silver. The modest position in Bitcoin was a drag.

Whisky vs FTSE 100

The long-term performance remains strong, with historical returns 5.3% per annum higher than the market since inception in 2016, but with similar volatility in recent years. That gap means the index delivered 96.6% in contrast to Whisky of 202.1%. Unlike Soda, the Whisky Portfolio has consistently delivered returns above the FTSE100, delivering twice the return since 2016.

Whisky Performance

The stock selection process has gone from strength to strength, and we’ve recently welcomed our new Senior Equity Analyst, Kit Winder, to the team. The ByteTree models cover the top 1,500 stocks. They seek out value and trends wherever they can be found. Not all stocks we add end up successful, but most do, and that delivers steady excess returns over time. Most of our holdings are blue chips, but overall, the average market cap is much lower than the large caps that dominate the indices.

One thing they all have in common is a well-reasoned investment case based on sound financial analysis. In all cases, the balance sheets are in good health, and the valuations are attractive. The Whisky portfolio is diversified.

Outlook

Q1 was relatively calm in comparison to the first few days of Q2. My highest priority is capital preservation, and that means running portfolios with reduced risk. The best thing about bear markets is that they eventually come to an end, and when they do, there is a sea of opportunities.

Thank you to all ByteTree clients for your continued support.

The Multi-Asset Investor is offered as a monthly subscription on ByteTree.com - learn more.