John Reade, chief strategist at the World Gold Council, pointed out last week that the Shanghai Premium was back. That simply means gold is more expensive in China than on the world market. This happens every other year or so, but this time, it witnesses the highest premium ever recorded.

Highlights

China The Shanghai Premium Returns

Reserves Chinese Reserve Growth Offsets ETF Outflows

Macro Growth Stalls, Currency Declines

Valuation Better in China

Regime Still a Bull Market

The Shanghai Premium Returns

Source: Bloomberg

In August, China continued to build its reserves, and the Chinese ETFs saw inflows. That contrasts with the rest of the world’s gold ETFs, which have seen significant outflows. The Shanghai Premium narrowed slightly on Monday as the People’s Bank of China lifted temporary curbs on gold imports. Yet it has widened again.

The Chinese growth miracle is over, and the currency is falling. Gold is an effective way to get wealth “out of the country” while still being in the country. That is the beauty of liquid alternative assets.

I have followed the Shanghai Premium for several years, and it has been bullish. The red lines mark premia since 2008. A rally in the gold price tends to follow, essentially because Chinese demand is elevated and sometimes substantial.

A Premium Is Bullish

Source: Bloomberg

Notice also how discounts, when gold is Cheaper in China than elsewhere, have been both rare and brief. The important period came after COVID-19 wandered out of the lab in Wuhan. The discount in June marked a peak in the gold price, which lasted for three years. Notice how the current premium is unusually high, which has led to an increase in smuggling.

In recent years, China has become increasingly important in the gold market and has more influence on price. In 2014, they launched the Shanghai Gold Exchange, and the PBOC has been increasing official reserves, which some people believe are heavily understated. That may well be true because China’s official gold reserves, as a share of global gold reserves, are just 5.9%.

Chinese Reserve Growth Offsets ETF Outflows

Source: Bloomberg

5.9% seems low for the world’s second-largest economy. For reference, Europe holds 11.7% of and the USA 22.8%. Putting it all together, the developed share is falling while the emerging share is growing. Recent behaviour by the PBOC suggests that China is keen to catch up.

This has been hugely important for the gold price over the past year or two. Gold analysts have become used to the idea that the gold ETFs represent the marginal buyer, and therefore are the price setter. For 15 years, we could closely correlate the gold price with ETF flows, but recently, that relationship has broken down.

Gold Holds While ETF Flows Decline

Source: Bloomberg

Since 2020, a staggering 21 million ounces of gold have left the vaults. The ETFs peaked at $220 billion but today slump at $171 billion. You might reasonably expect that to have knocked the gold price to around $1,700 per ounce, but it hasn’t. Perhaps it is the growth in Chinese Reserves that has offset the fall in ETF holdings. The chart shows Chinese reserves and ETF holdings combined.

Chinese Reserve Growth Has Offset ETF Outflows

Source: Bloomberg

The bottom line is there is a higher demand for gold in China than elsewhere, which comes from the people seeking a safe haven for their money and the government seeking more influence. They say, “all paths lead to gold”.

Growth Stalls, Currency Declines

There are many ways to show economic activity in China, but official GDP statistics are best avoided. Since 2006, the Growth vs Value trajectory for Chinese and US stocks has been a close match. That is until recently. The chart is rebased, which highlights both the extent of the growth and the fit. Both have been remarkably similar for 20 years, yet something has changed.

Growth vs Value in China and the US

Source: Bloomberg

This is yet another of the many data divergences that seem to have cropped up following lockdowns and wars. Things are changing, and the chart above suggests that China is no longer being led by growth stocks, which implies their expansion has stalled while the USA carries on. Of course, the US market could be rolling over too, which seems very likely given the nosebleed valuations across US growth stocks. Still, it has been worse for China.

A devaluation is generally a good idea during an economic slowdown because it makes the country more competitive, but don’t mistake it for creating value. It simply cushions the blow by making recessions slightly less painful.

It might look as if a devaluation began in 2014, but it didn’t. That is demonstrated by the lower chart where the Yuan is measured against a global currency basket ex USD. It has held up remarkably well and only started to devalue in mid-2022 and has recently bounced off the ten-year low.

Chinese Devaluation

Source: Bloomberg

For all the talk of China’s great devaluation, in truth, it has barely begun. Yet the currency has eased slightly, which is the outcome of low interest rates. In contrast to the US and Europe, the PBOC has been easing monetary policy in an attempt to boost growth.

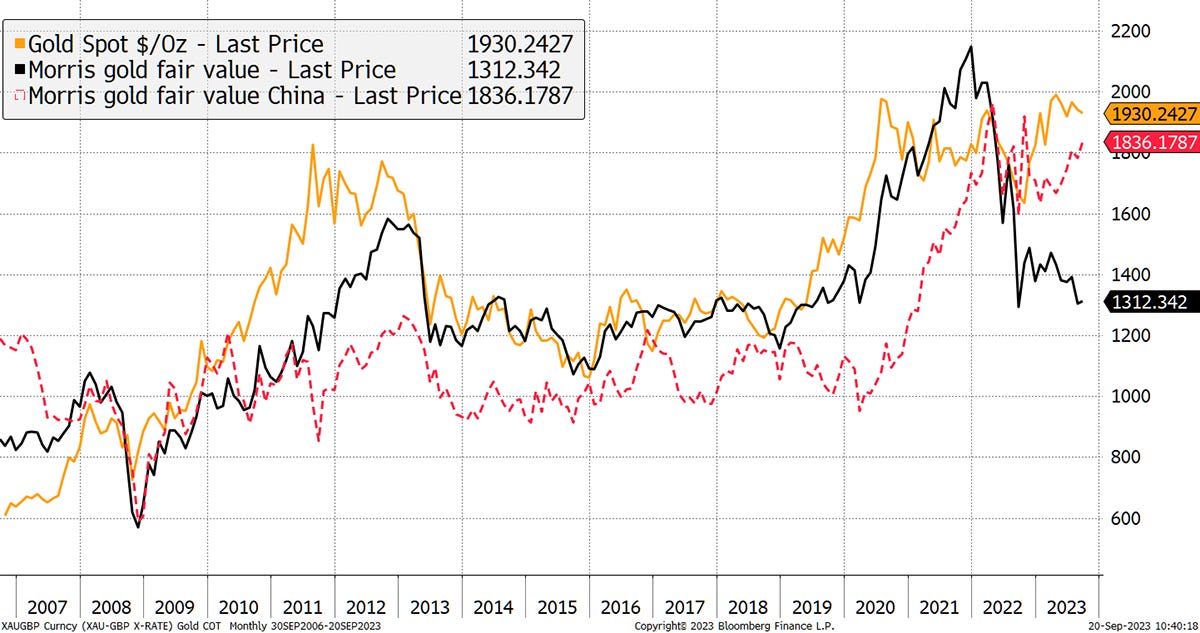

Let us not forget that low rates are good for gold. My gold valuation model is boosted by low rates and high future inflation expectations. The worst scenario is high rates and falling inflation, which is more or less where we are today. The great hope for gold is that inflation proves resilient while rates come back down. Using US rate data, the fair value has slumped to $1,312, which is brutal and reflects how tight monetary conditions already are.

However, substituting the Chinese long bond for the US Treasury, the fair value jumps from $1,312 in the USA to $1,836 in China. Which rate will be more influential for the gold price in the future? Certainly, the correlation with the latter has been growing at the expense of the former.

Gold Fair Value Is Much Higher in China

Source: Bloomberg

There can be no doubt that China is becoming a more important determinant of the gold price than it has been in the past. Gold is deeply rooted in their culture, and they understand the macroeconomic benefits and status of having credible gold reserves.

Regime

Finally, I will run through my three key gold regime models. If two or more are bullish, my thesis is that gold is in a bull market. Spoiler alert: it still is.

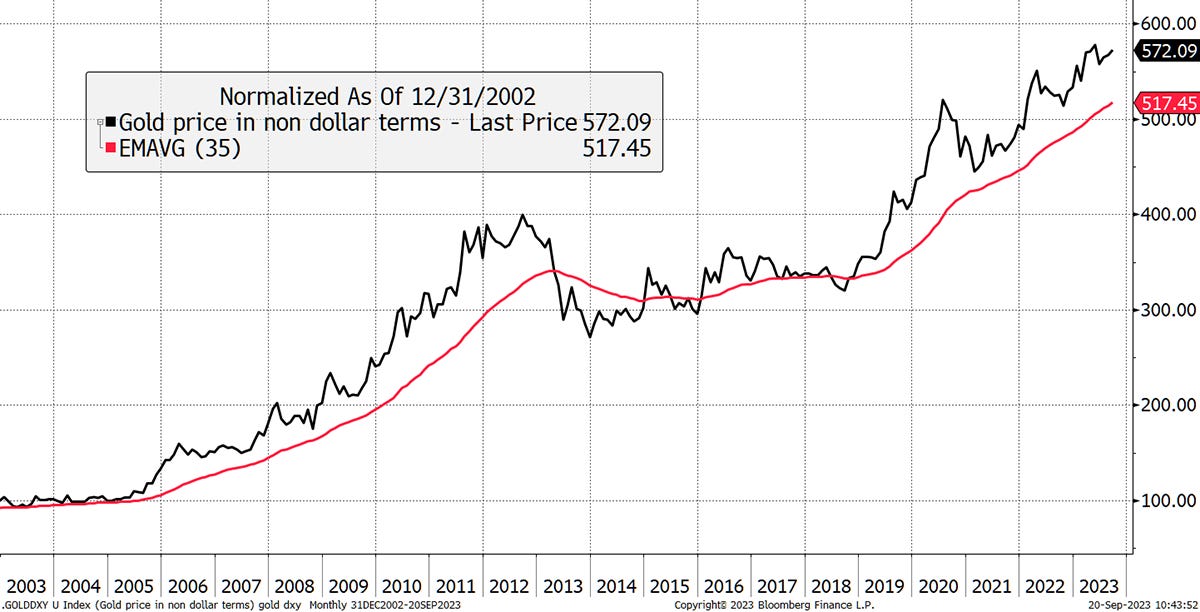

First up, gold remains strong in non-dollar terms as the price is rising in virtually all currencies. Over the past year, only the Mexican Peso is ahead.

Gold Price in non-Dollar Terms Remains Strong

Source: Bloomberg

Compared to the stockmarket, gold is also doing well. Admittedly, less so against the S&P 500 (shown), as tech has been so strong this year. But gold is ahead of the rest of the world stockmarkets and the US equal weight index, which is less exposed to technology. The bottom line is that gold is doing fine against equities.

Gold Firm vs Equities

Source: Bloomberg

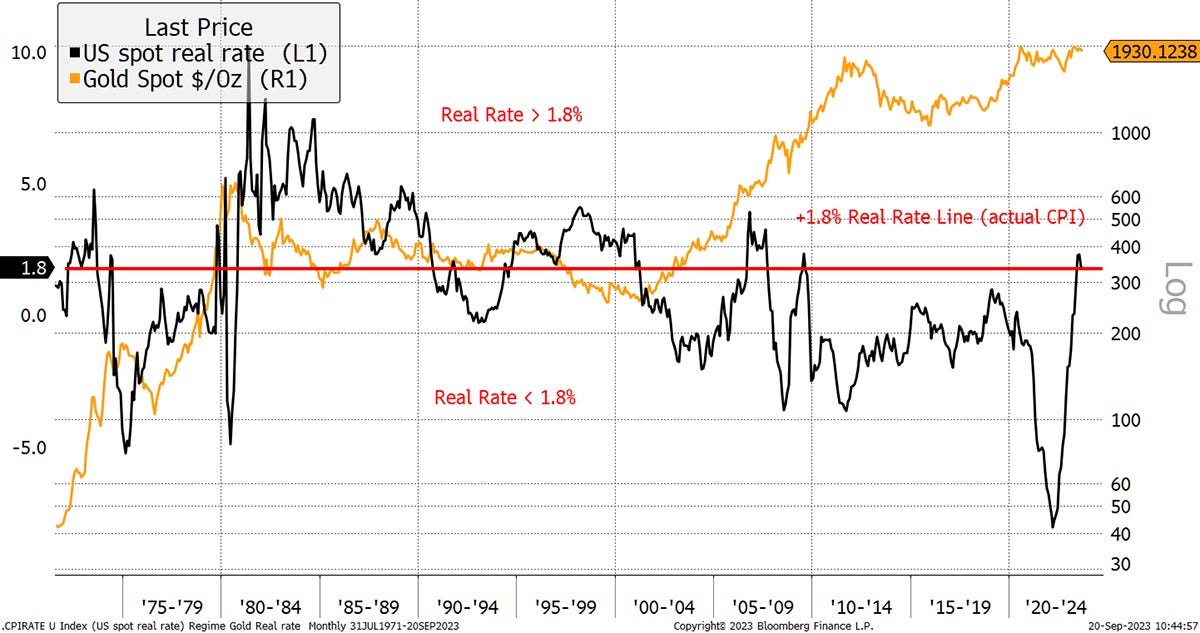

The final test is more worrisome for gold because real interest rates (the base rate less inflation) is 1.8%, which is the threshold. Historically, when real rates have been above 1.8%, gold has been in a bear market.

Real Rates Are a Little High

Source: Bloomberg

But consider this happened in 2006, and that was fine. It’s more a case of realising that real rates can go too high, and that kills gold bull markets. The other observation is that sustained periods of positive real interest rates haven’t been seen in the 21st century. Many believe the financial system, saddled by debt as it is, cannot handle it.

I agree, and some of gold’s appeal is that it is the oldest, and most widely held, form of sound money.

BOLD

Gold has such a high status as an alternative monetary asset that Bitcoin was presented as a modern alternative. ByteTree’s BOLD Index combines Bitcoin and Gold on a risk-weighted basis and rebalances each month.

The recent malaise in markets began in January 2022. Since then, US Treasuries are down 36% and the S&P 500 8%. Gold is up 7%, with Bitcoin down 43%, yet BOLD has been remarkable under the circumstances.

BOLD Since the Bear Began

Source: Bloomberg

To learn more about BOLD, read our September rebalancing report, and please sign up to our mailing list for monthly updates.

Physical Gold and Silver

If you are interested in buying physical gold or silver and would like to do so before China buys it all, my recommended bullion dealer is The Pure Gold Company. You can take delivery of your metal in the UK, US, Canada and Europe or leave it in their safe custody. The trading costs are low, while the quality of service is high, as shown on Trustpilot. For more details on The Pure Gold Company, please visit their website.

Summary

Last night, the Federal Reserve said interest rates will be higher for longer. It hasn’t gone down well so far, and gold is down along with stocks. But when rates start to fall, perhaps late next year, gold will meaningfully outperform stocks, just as it did in dotcom and 2008.

The Gold Dial Remains in Bull Market.