What do you think would happen to the BTC price if you tried to sell $56 billion from the Bitcoin ETFs? I’d estimate it would fall below $10k.

Highlights

ETFs and Flows: Bitcoin Volumes Overtake Gold

Silver and Miners: Silver or Miners?

Argentina: The Austrians Are Winning

Bitcoin Volumes Overtake Gold

I sense a reluctance in gold circles to acknowledge the extraordinary success of the Bitcoin ETFs, now worth $74 billion. They hold over a million bitcoins and have seen the largest inflows on record in the 30-year history of ETFs. These new records used to be held by gold.

The new nine US spot Bitcoin ETFs launched on 11 January. The dollar trading volumes of all Bitcoin and Gold ETFs > $2bn are shown. Bitcoin ETFs started off in line with Gold, but in recent weeks, they have shot past it. A typical day sees gold trade $2 billion and Bitcoin ETFs four times that. I think gold fans should pay attention.

The gold ETFs hold $163bn, and the Bitcoin ETFs hold $74bn. Gold ETFs are $56 billion down from their high in 2020, whereas bitcoin ETFs are making new highs. It remains a mystery why asset allocators, many of which ignore Bitcoin, continue to sell their gold.

Bitcoin and gold assets combined amount to $237bn, and Bitcoin has a 31% growing share.

It is easy to jump to the conclusion that Bitcoin is taking over from Gold, but I disagree for the following reasons:

Central banks are unlikely to swallow the orange pill and buy Bitcoin. Possibly ever.

Bitcoin has a non-zero chance of failure.

No evidence that Bitcoin’s outsized cyclicality has ended.

Points 2 and 3 are insignificant compared to 1. The central banks have the cash. Gold is not dead, or even close to it, while the central banks continue to store and exchange value via the hugely liquid $150 billion/day gold market.

Besides, if you tried to sell $56 billion from the Bitcoin ETFs, what do you think would happen to the price? I’d estimate it would fall below $10k. Do that to gold? It makes an all-time high. $56 billion is too piddly to move the dial in this $15 trillion asset class.

That said, Bitcoin has clear advantages for the individual, as it is more portable and technologically integrated and, as a result, has more applications. There is no question that Bitcoin is more exciting.

In my opinion, Bitcoin and gold are not in competition with each other any more than bonds are in competition with equities. One is risk ON, and the other is risk OFF, and they will coexist for a long time to come.

Silver or Miners?

We all know Bitcoin made a new all-time high because it was broadcast live on CNBC. Gold? Less so. But I like that because quiet bull markets always seem to be better underpinned than noisy ones. Watch out, Bitcoin bulls!

If gold is in a bull market, it is time to look at the gold miners and silver. I wrote about that last week and will share the highlights.

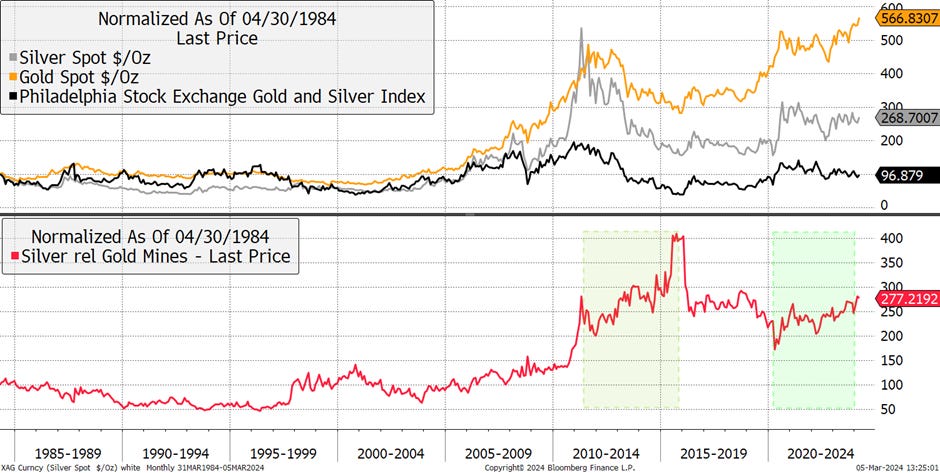

Going back to the 1980s, the gold miners index has made no money at all, while gold has performed twice as well as silver.

Gold, Silver and Miners

The thing that stands out since 2011 is how the miners beat silver in the 2015 to 2020 period when gold was going up. In the periods before and since, the miners have lagged silver. It is a simple and perhaps obvious conclusion that the gold miners will beat silver in a gold bull market. I say it is obvious, but that wasn’t necessarily the case pre-2011.

Now that’s established, we can see that the miners troughed relative to gold in 2015 and now trade in a range above and below the average shown. If this continues, the gold miners have room to do nearly twice as well as gold over the next couple of years.

Gold and the Gold Miners

Finally, it becomes clear that the miner’s valuation in absolute terms, at 1.4x, is attractive. The historical average has been higher, but I’ll only assume the post-2013 average. There is room for a re-rating in a gold bull market, and the miners reached 2.5x in 2020 when the gold price was $100 lower.

Miner Valuations Attractive

This is not the time to be selling gold. And for those with the appetite, the gold miners should beat silver, but both should do well.

Physical Gold and Silver

If you are interested in buying physical gold or silver, our recommended bullion dealer is The Pure Gold Company. You can take delivery of your metal in the UK, US, Canada, and Europe or leave it in their safe custody. The trading costs are low, while the quality of service is high, as shown on Trustpilot. For more details on The Pure Gold Company, please visit their website.

The Austrians Are Winning

Most gold watchers sympathize with the Austrian School of Economics. In recent decades, we haven’t seen much of that, which is why Argentina’s new President, Javier Milei, is so fascinating to follow. My old friend, Rob Marstrand, has lived in Buenos Aires for 15 years and has written an excellent summary of the ten-point plan. Here are the highlights:

Balance the budget

Fiscal spending to 25% of GDP

Reform tax

Open trade

Promote work

End money printing

Quash corruption

I commend his short but excellent piece; it’s a must-read.

Summary

I sense we will all need Milei soon, and there’s always BOLD while we wait.

Webinar

Don’t miss out on this rare opportunity! Join our upcoming webinar, “Bitcoin and Gold in 2024: Meet the Managers”, where the world’s top three Bitcoin and Gold fund managers will explore the converging landscapes of these two assets.

Discover how Gold is becoming increasingly relevant to the digital age, while Bitcoin gains traction among institutional investors. Delve into crucial questions: Why do governments and regulators favour Gold over Bitcoin? What would it take for central banks to embrace Bitcoin? Are Bitcoin and Gold truly in competition as investments, and how would one balance a portfolio between the two?

Register now and be part of this pivotal conversation shaping the future of finance.

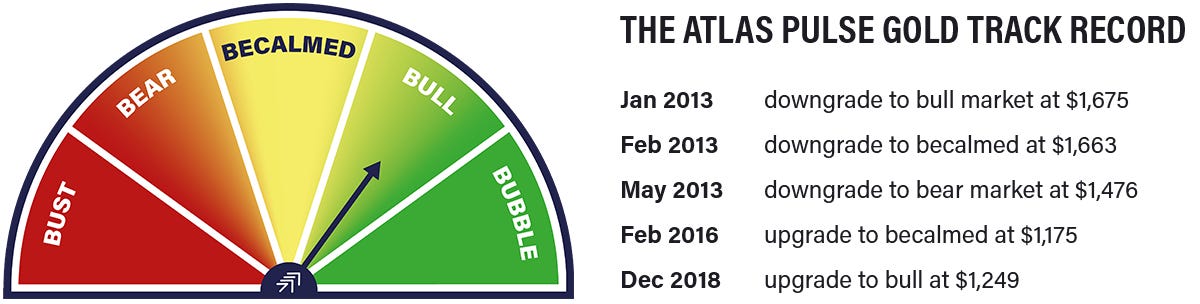

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market. Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or by commenting below.

Great piece. I'm only 2 years into metals investing and am having a difficult time understanding the miners not participating in the recent moves. Quirky space.

Also curious how you estimate the price of Bitcoin assuming a huge outflow from the ETF's? You must be assuming their introduction will add to volatility because ETF volume dwarfs "normal" activity? I recognize your example is hypothetical, just curious how you get sub $10K?