Following the rebalancing on 30th June 2025, the new target weights for the BOLD Index are 30.5% Bitcoin and 69.5% Gold, a further 0.7% increase for Bitcoin over the previous month. Once again, as Bitcoin’s volatility falls and Gold’s volatility increases, the BOLD Index has increased exposure to Bitcoin at the expense of Gold. This is Bitcoin’s highest ever target weight in the history of the BOLD Index.

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 29.8% and 70.2% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 30.1% Bitcoin and 69.9% Gold. This means the latest rebalancing has seen 0.4% added to Bitcoin and reduced from Gold to meet the new target weights.

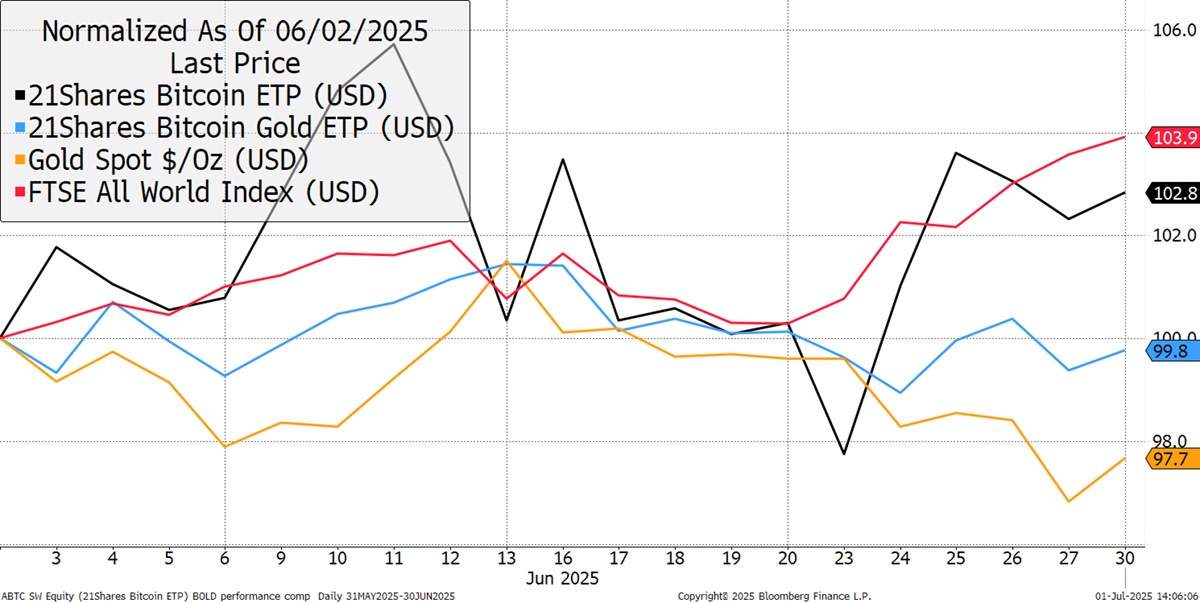

BOLD Performance

In June, BOLD fell by 0.2%, Bitcoin rose by 2.8%, and Gold fell by 2.3%, while global equities rose by 3.9% in USD terms. The US dollar was down 2.5%.

Bitcoin, Gold, BOLD, and Equities in USD – June 2025

Over the past year, BOLD has returned 54.1%, Bitcoin has returned +73%, in contrast to Gold with a +44.5% gain, while equities have risen by +21.3%.

Bitcoin, Gold, BOLD, and Equities - Past Year

Since the 21Shares ByteTree BOLD ETP's inception on 27th April 2022, BOLD has returned +112.4%, Bitcoin has returned +163.9%, Gold is up +75.1%, while equities have risen by +40.2%.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 38.8% and 17.1%, respectively. Bitcoin's 360-day volatility has fallen again over the past month, while Gold’s has risen. This is a continuation of what happened in April, and the gap between Bitcoin and Gold volatility is historically narrow. This has led to the highest Bitcoin weight on record for the BOLD Index.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility were ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 30.5% Bitcoin and 69.5% Gold using this formula.

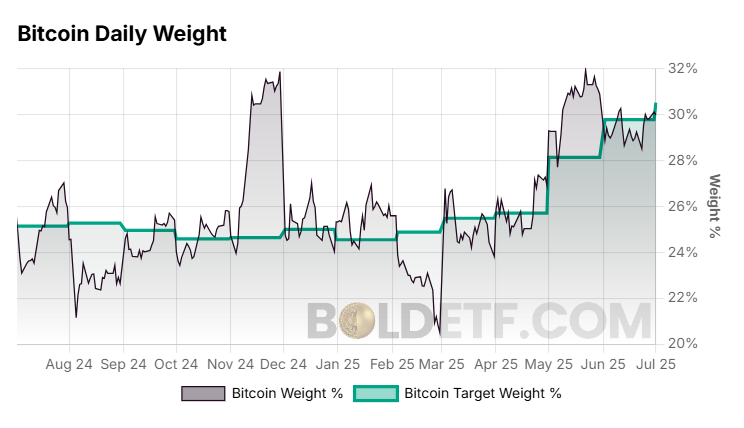

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold. This recent weight is a new high for Bitcoin within the BOLD Index and the first time it is above 30%.

BOLD Rebalance Weights

Zooming in on the difference between Bitcoin and Gold volatility, Bitcoin has been falling while Gold has been rising. The difference or spread is shown in blue. They were 50% apart in late 2021, 29% last year, and now just 24%. I suspect this spread will narrow over the coming years, further boosting the Bitcoin weight in the BOLD Index.

Bitcoin and Gold’s Past 360-day Volatility with the Spread

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy and hold. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Bitcoin: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, like it did in February, it would be boosted back up to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

This rebalancing is also a source of excess return. The red line shows the Bitcoin and Gold performance at the weights from April 2022 to date. The excess return of BOLD (after fees) has been 19.5% since the ETP was launched. Rebalancing transactions pay, and nowhere more so than in Bitcoin and Gold.

BOLD Rebalancing Has Added 20.8% over 3 Years over Buy and Hold

If Bitcoin was particularly strong one month or Gold weak, the rebalancing process would reduce Bitcoin exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and is a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold

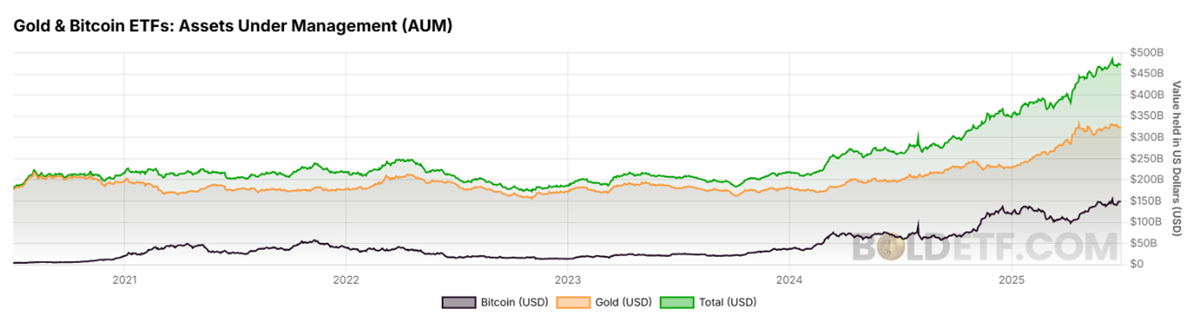

Bitcoin and Gold ETF Flows

ETF flows have been favouring Bitcoin in April and May, but that has turned back in favour of Gold over the past week.

90-day Bitcoin and Gold ETF Flows

It is notable that the total value of Bitcoin and Gold ETFs has surpassed $450 billion.

Gold and Bitcoin ETF AUM

Visit BOLDETF.com, which is full of data and charts to help investors better understand the benefits of the strategy.

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow. The fund now holds $28.6 million of Bitcoin and Gold held in safe custody with Copper for Bitcoin and JPMorgan for Gold. It trades actively in CHF, EUR, USD, and GBP in Switzerland, Germany, the Netherlands, France, and Sweden. The ticker is BOLD.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.