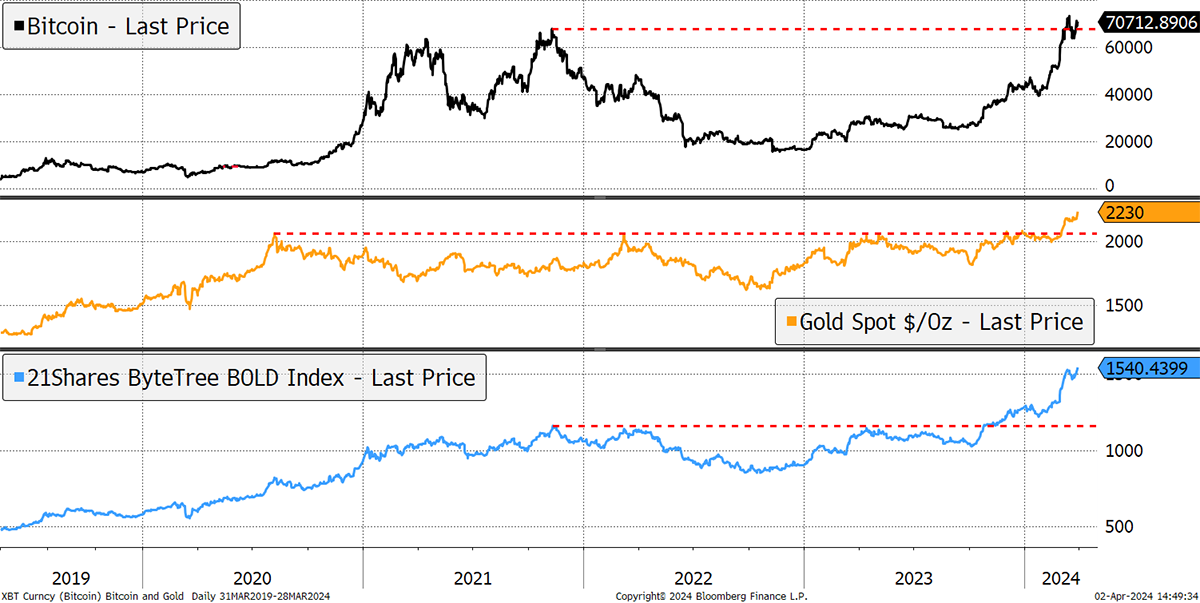

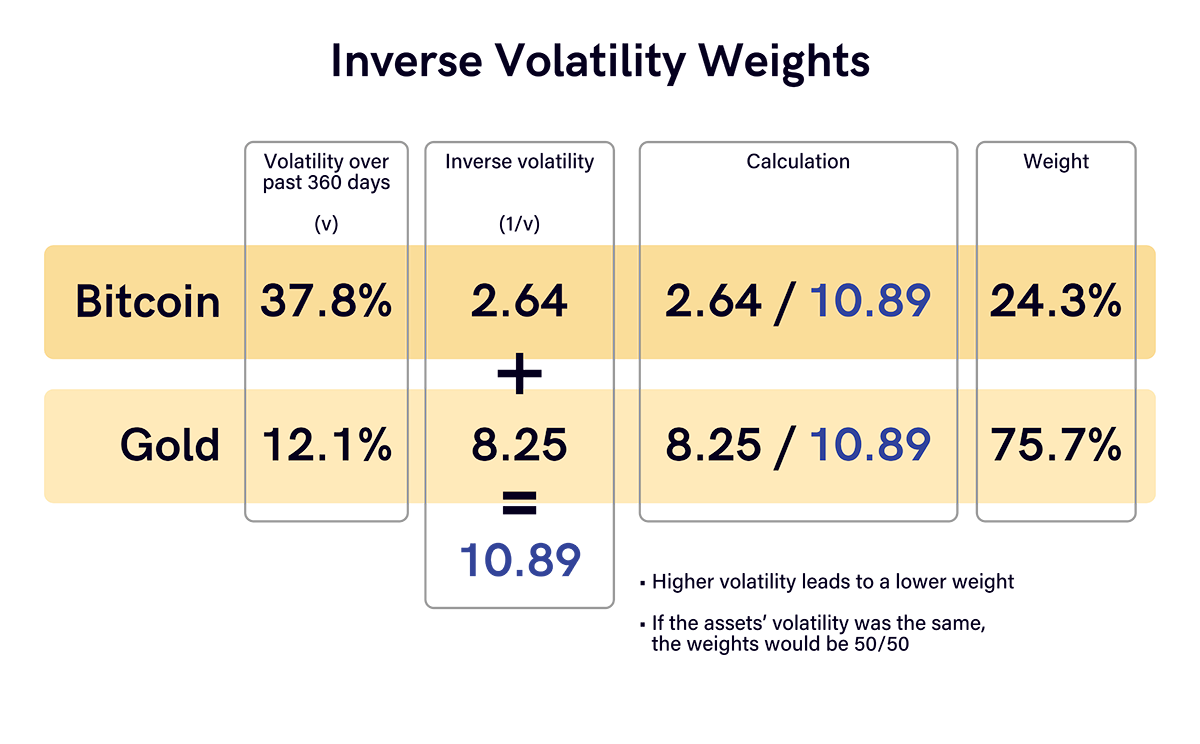

Following rebalancing on 31st March 2024, the new target weights for the BOLD Index are 24.3% Bitcoin and 75.7% Gold.

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

In March, BOLD rose by 9.5%, Bitcoin rose by 15.3%, Gold rose by 9.1%, while equities rose by 3.0% in USD terms. This month sees a modest rebalance in contrast to February, when Gold was flat while Bitcoin surged 44%. In March, both assets performed well, with Gold particularly strong on a risk-adjusted basis. On the last day of the month, BOLD exposure was 25.3% in Bitcoin, while Gold was 74.6%. The rebalance reduced Bitcoin by 1% to the new target weight and added the proceeds to Gold.

Both Bitcoin and Gold have recently made new all-time highs. Most investors see the reasons for the strength as monetary, especially given it is happening against a backdrop of a strong dollar and a weak bond market. The normal link is to see Bitcoin and Gold rise when bonds are strong and the dollar is weak. This new regime suggests instability in macro-economics and/or geopolitics. Investors are looking for higher exposure to liquid alternative investments.

All-Time Highs for Bitcoin, Gold and BOLD

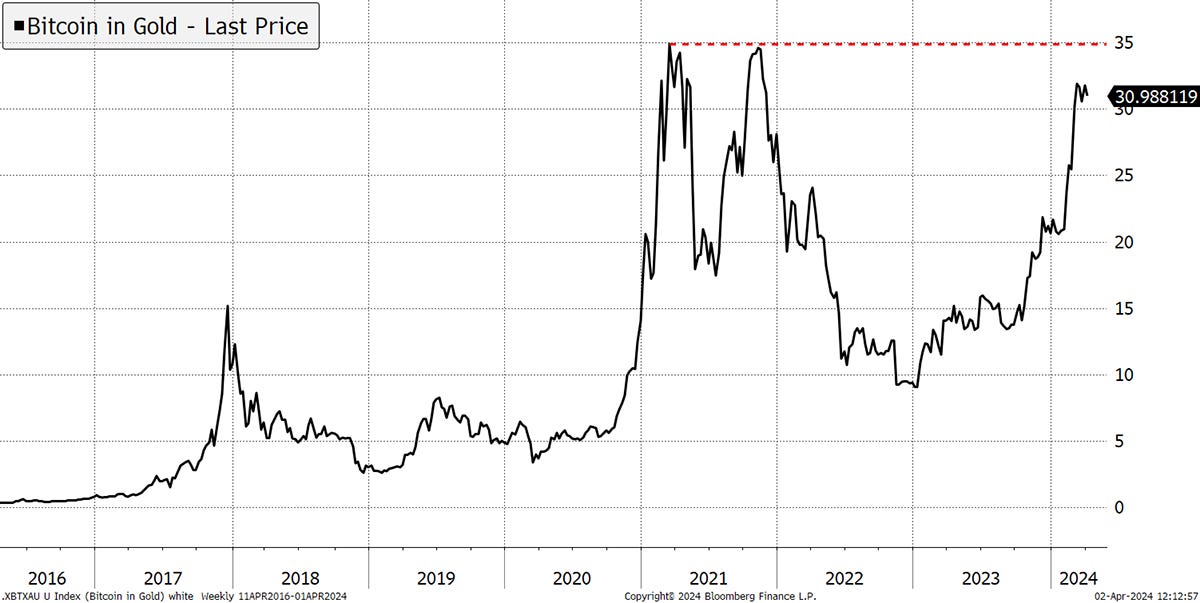

When we observe Bitcoin priced in Gold, it has not made an all-time high. Indeed, Bitcoin has enjoyed a strong move for 15 months, whereas Gold is just getting started. The price of Bitcoin has never exceeded 35 ounces. It has retested this level twice, and so far, it has failed. Yet, it is expected to happen one day.

Bitcoin in Gold Has Not Made a New High

But that day may not be soon. Despite the upcoming Bitcoin halving on 20th April, the huge flows into the Bitcoin ETFs have started to slow down, and this 15-month rally is losing momentum.

Bitcoin ETF Inflows

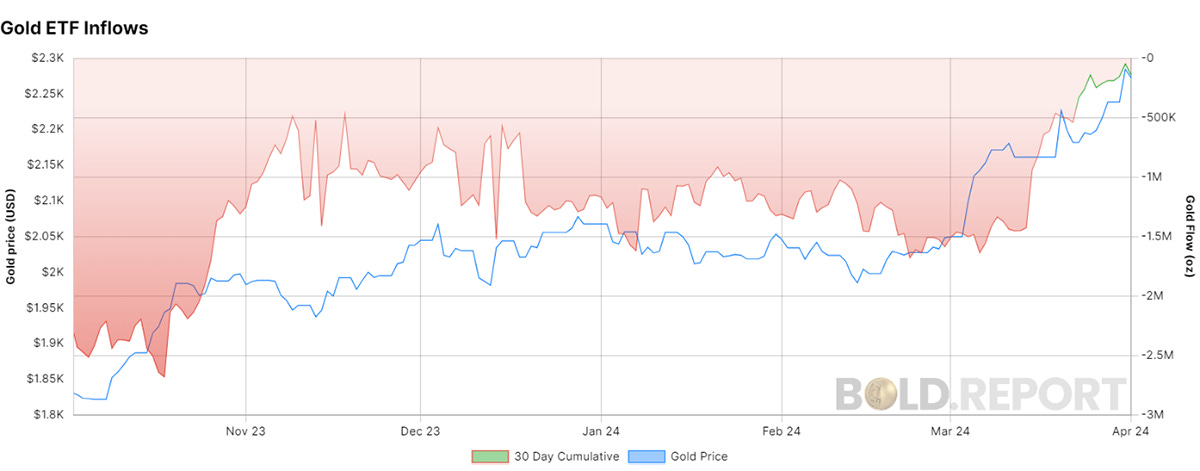

At the same time, the outflows from the Gold ETFs have ceased, and investors are returning. Around 5.5% of Bitcoin is held in ETFs, against 1% for Gold. ETF flows are, therefore, more important for Bitcoin than Gold.

Gold ETF Inflows

That is bullish, but the real story behind Gold is the huge demand from China, which has been accumulating Gold reserves in recent years. This is expected to continue as the bond market is no longer deemed to be free of risk.

BOLD Performance

Over the past year, Bitcoin’s performance has been remarkable, returning 149%, in contrast to Gold, with 13%. BOLD managed a respectable 40% return.

Bitcoin, Gold, BOLD, Equities in the Past Year

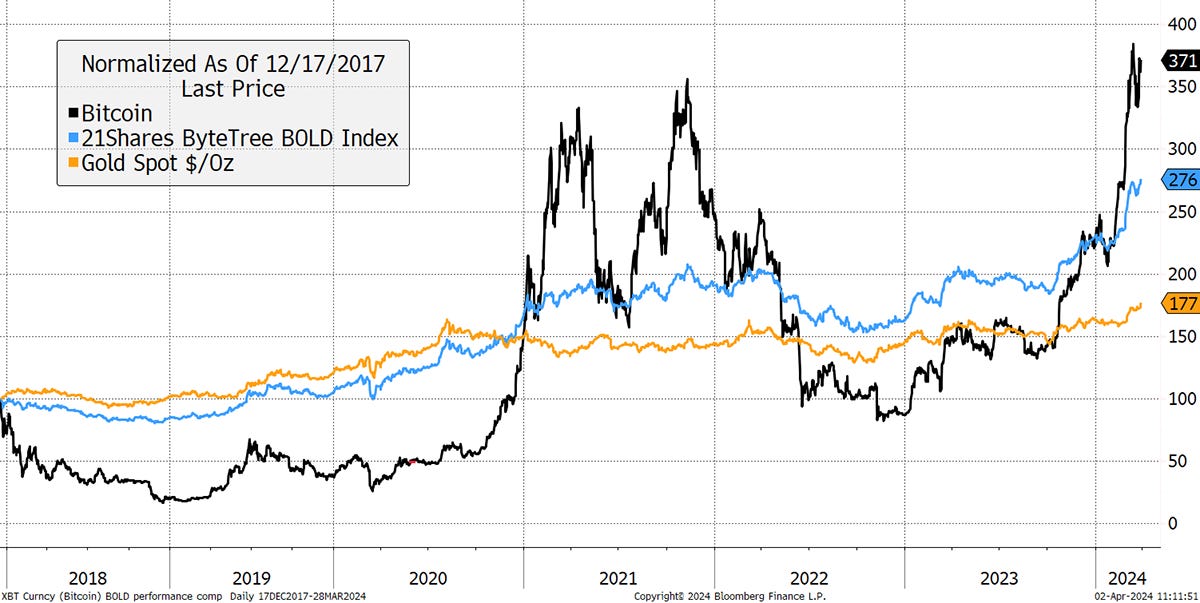

However, over the longer term, Bitcoin’s lead is slightly more modest. The last two notable all-time highs for Bitcoin occurred in December 2017 ($19,041) and November 2021 ($67,734). Starting with 2021, Bitcoin is +4%, while Gold is +22% and BOLD is +36%.

Bitcoin, Gold and BOLD Since the November 2021 Bitcoin High at $67,734

Since the 2017 peak, Bitcoin is +271%, while Gold is +77% and BOLD is +176%.

Bitcoin, Gold and BOLD Since the December 2017 Bitcoin High at $19,041

In both cases, an allocation of 25% Bitcoin and 75% Gold would have led to lower returns.

2021 peak: Bitcoin +4% and Gold +22% means the 25/75 combination returned 17.5%, yet BOLD returned 36%. That is an excess return of 18.5%.

2017 peak: Bitcoin +271% and Gold +77% means the 25/75 combination returned 125%, yet BOLD returned 176%. That is an excess return of 51%.

The longer horizons demonstrate not only the defensive qualities of BOLD but also the potential to generate higher returns.

BOLD Rebalancing

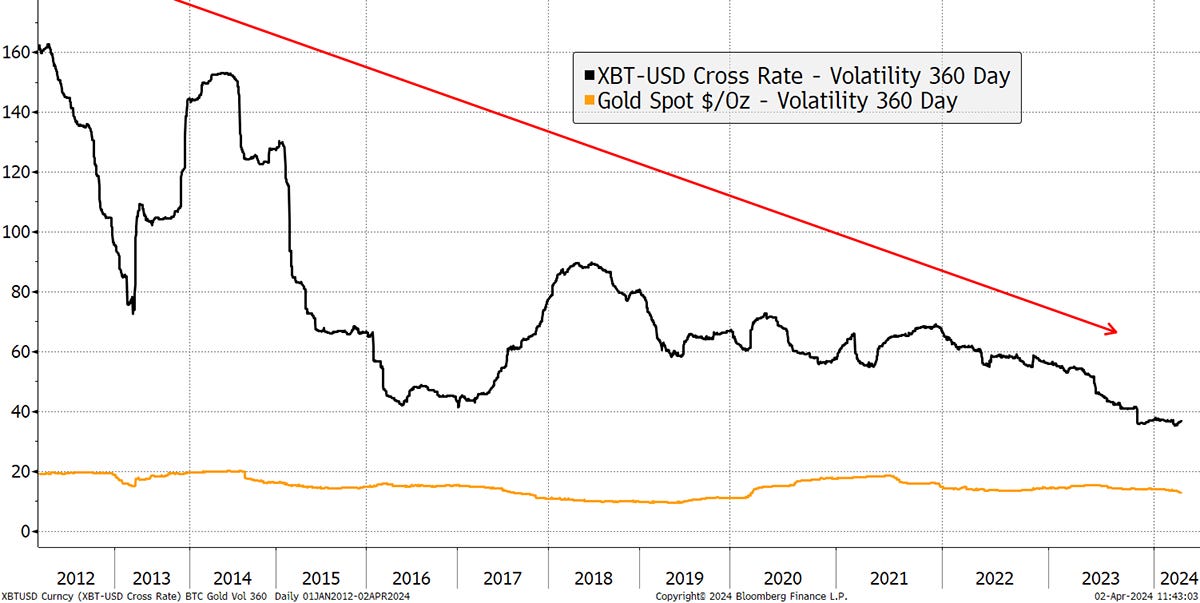

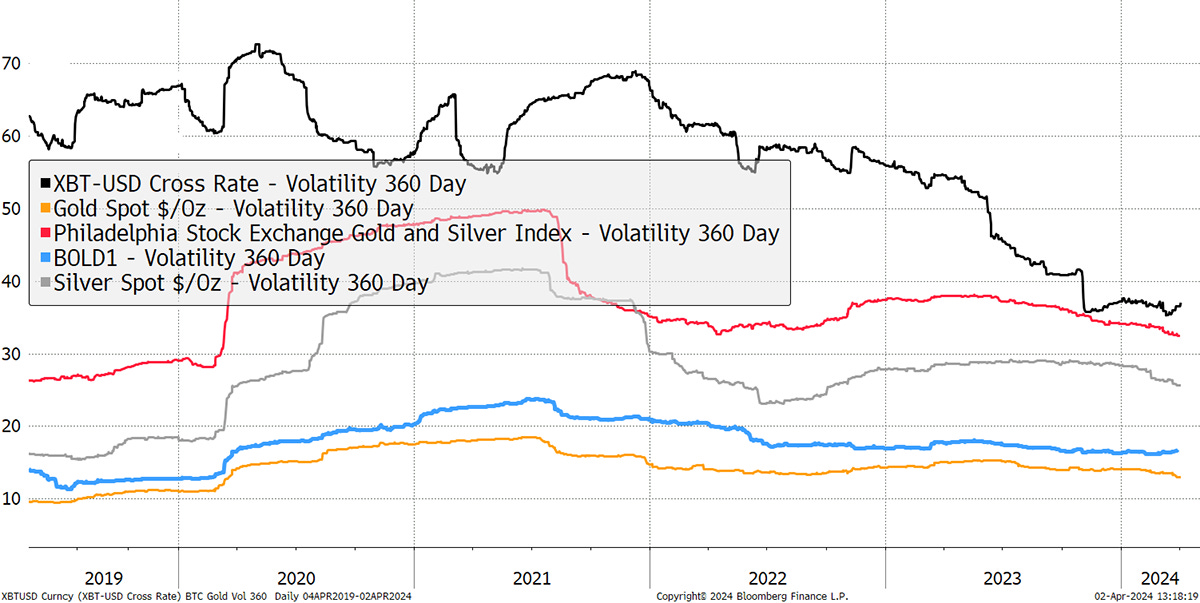

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

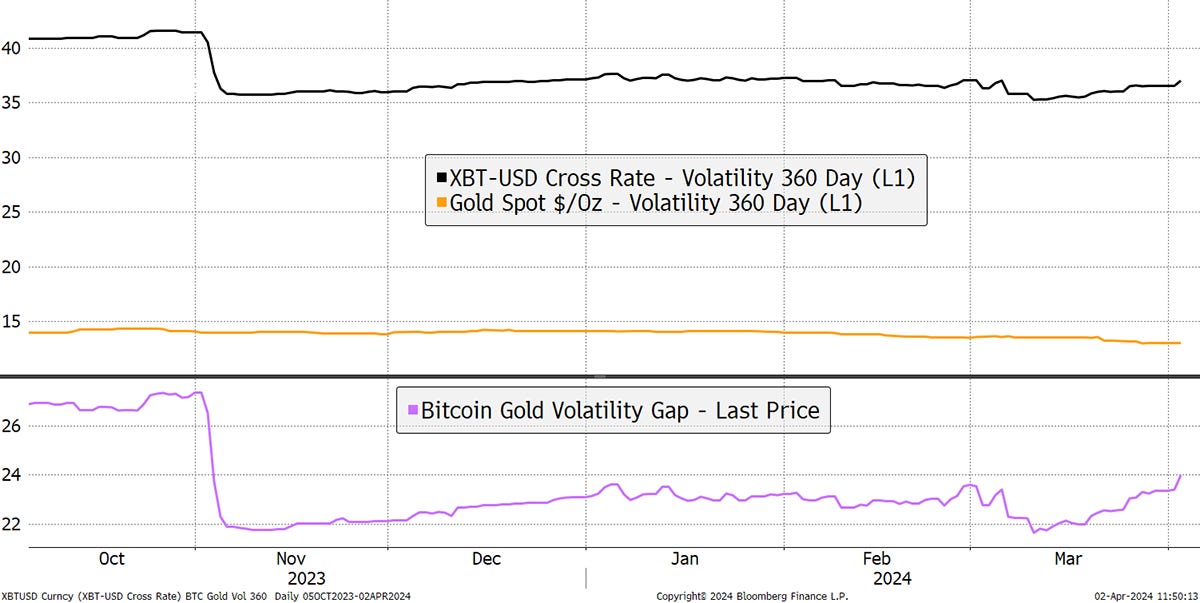

Bitcoin and Gold Past 360-day Volatility

While Bitcoin volatility has been falling over the long term, the difference between Bitcoin and Gold volatility (the spread) has recently been rising.

Bitcoin and Gold Volatility Spread Is Rising

This means the exposure to Bitcoin has been reduced, even if slightly.

The volatility for Bitcoin and Gold over the past 360 days was observed to be 37.8% for Bitcoin and 12.1% for Gold. This has resulted in new target weights of 24.3% Bitcoin and 75.7% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. It is, hence, “risk-weighted”.

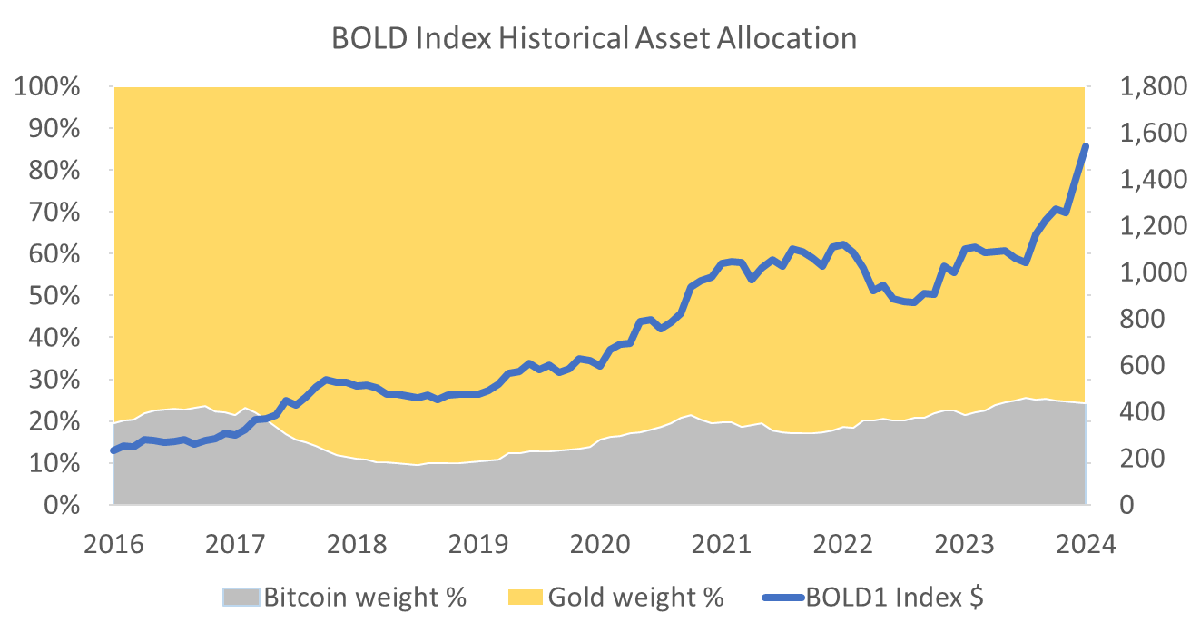

The BOLD allocation to Bitcoin was low in late 2017 and 2018 when Bitcoin’s volatility was high compared to Gold. Bitcoin exposure peaked at 25.5% in October but has been declining since the volatility spread has widened again. This is a key part of BOLD’s risk management.

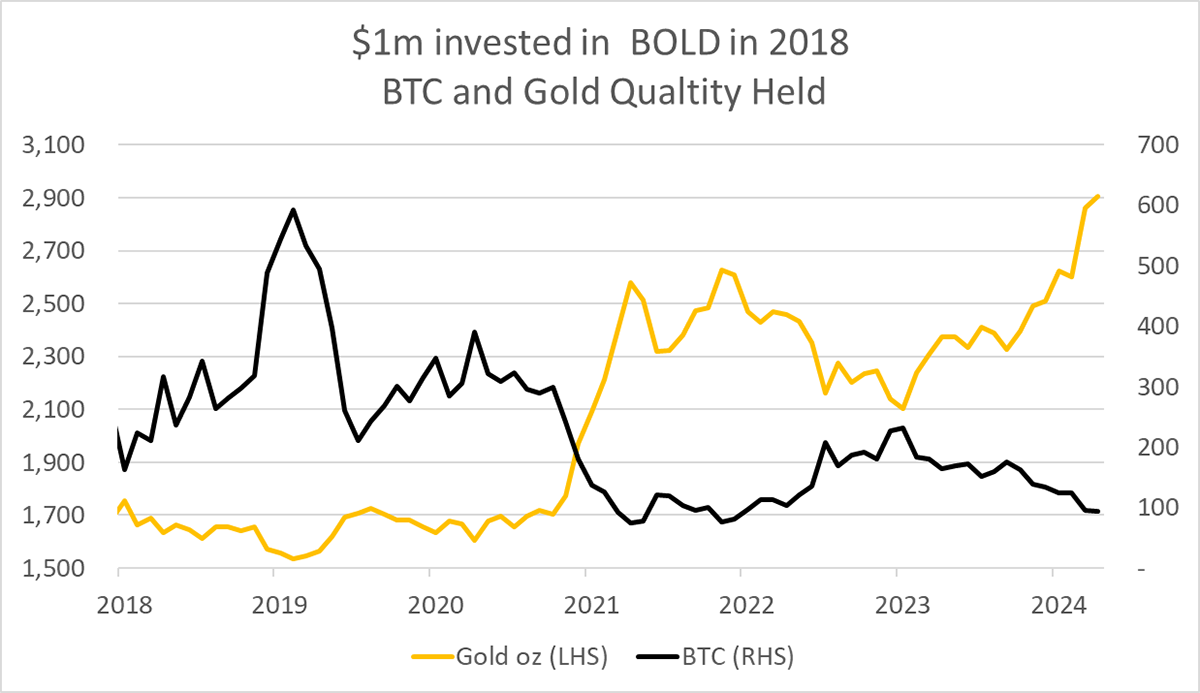

Rebalancing transactions occur at the end of each month, and this accumulates the weaker asset. In a Bitcoin bull market, that’s Gold, and in a Bitcoin bear market, that’s Bitcoin. Since the end of 2022, BOLD has been reducing Bitcoin and increasing Gold. BOLD would be well-positioned for continued strength in the Gold market.

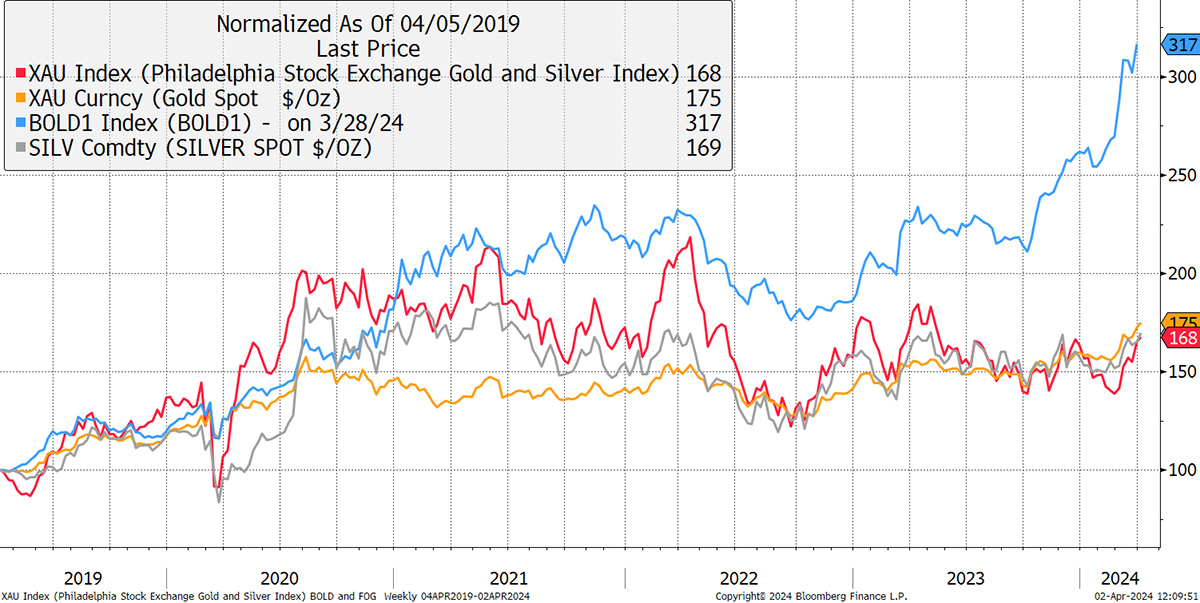

BOLD and Precious Metals

With the price of Gold making an all-time high, when investors have been selling since 2020, there is little resistance to continued upside. As you might expect, investors are asking whether they should buy Gold, silver, or perhaps even Gold mining stocks. In reality, Gold and “friends of gold” have remained closely aligned, with silver (grey) and the miners (red) running ahead in the bull markets and easing back during the bears. Remarkably, it has remained a tight race over the past five years.

BOLD Compared to Precious Metals and Mining Stocks

I covered this topic in more detail a few weeks ago. I concluded that the miners are likely to beat silver in this Gold bull market.

But regardless of whether Gold miners or silver deliver higher returns, BOLD is likely to outdo them all. Whenever Bitcoin rallies come, and they keep on coming, BOLD surges past, yet locks in much of the gains via rebalancing transactions.

The miners, and indeed silver, will likely outshine moist assets over the short to medium term, but I would always back BOLD to not only deliver higher returns but with lower volatility.

BOLD Volatility Compared to Precious Metals and Mining

It is remarkable how BOLD continues to outshine its friends and does so with consistently lower volatility.

Summary

With new all-time highs for both assets, things will become interesting. It is remarkable how institutional investors and wealth managers have been selling Gold since mid-2020 and are, by and large, yet to allocate to Bitcoin.

Mainstream investors have barely started on this journey.

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Research

ByteTree provides more in-depth research on Bitcoin and Gold for free on our website.